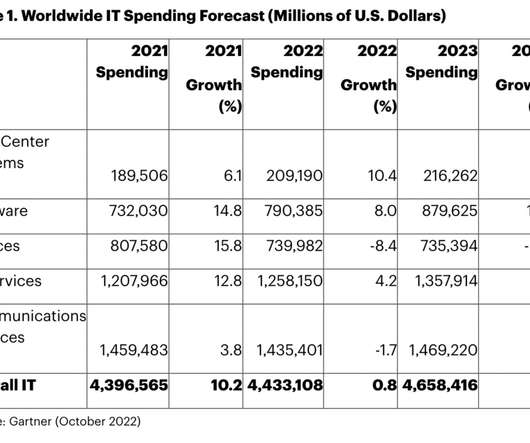

Gartner: Business Software Spend Still Forecast to Rise 11.3% to $880 Billion in 2023

SaaStr

OCTOBER 20, 2022

And they say 2023 will be a banner year for enterprise software spend at least — growing a stunning 11% to $880 Billion. And software is the biggest beneficiary, up 11.3%, even as other spend areas like devices are being put more on discretionary hold. The post Gartner: Business Software Spend Still Forecast to Rise 11.3%

Let's personalize your content