The Challenge with SMB SaaS: High Growth Can Only Mask High Churn For Just So Long

SaaStr

JULY 26, 2022

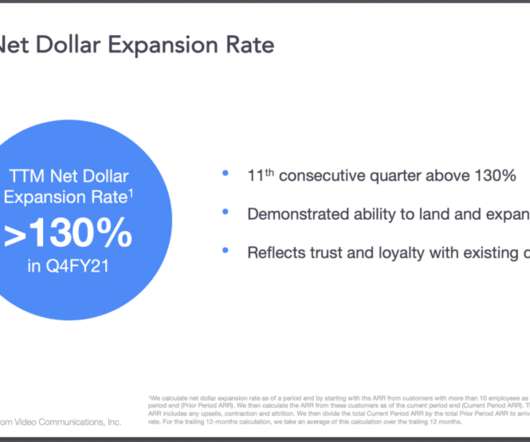

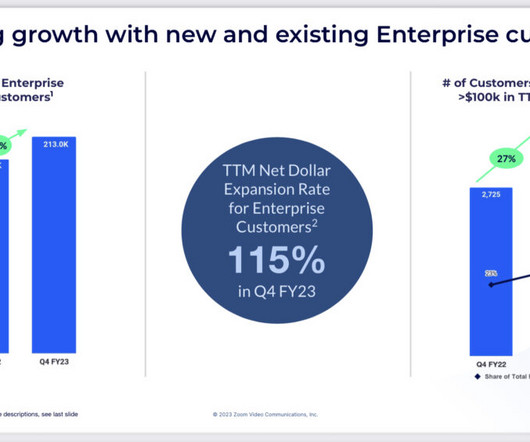

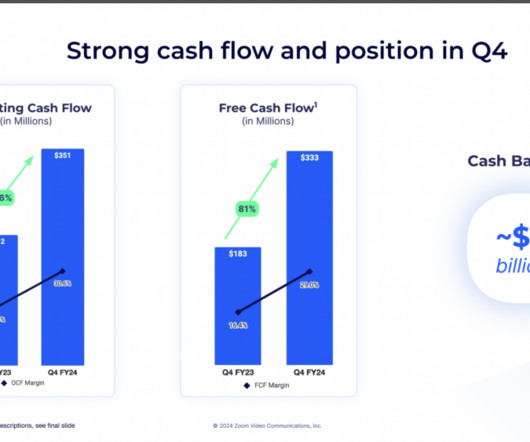

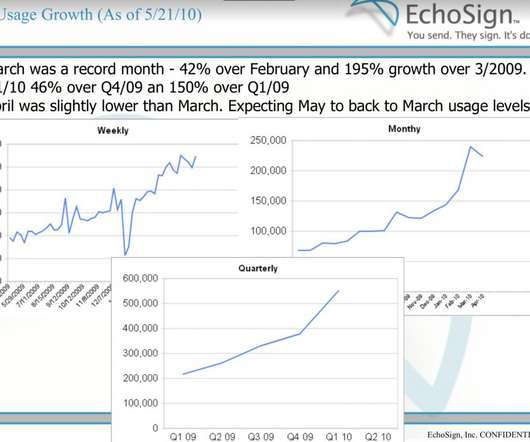

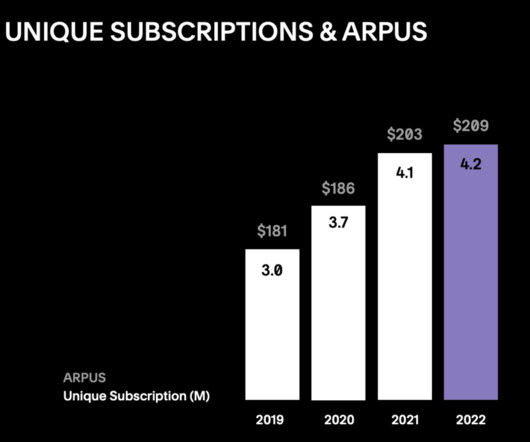

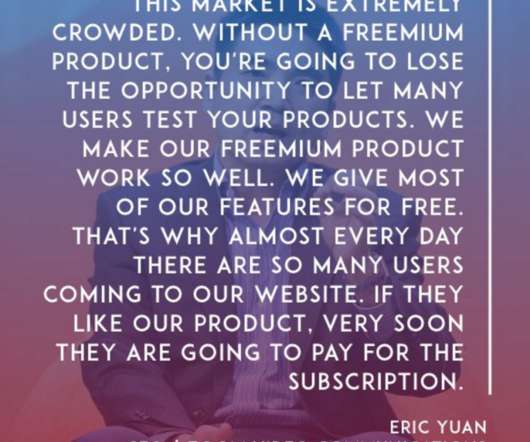

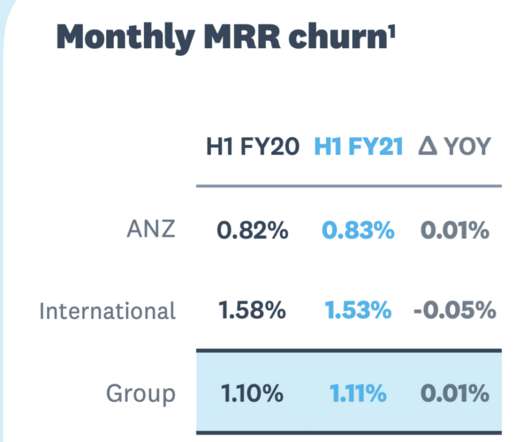

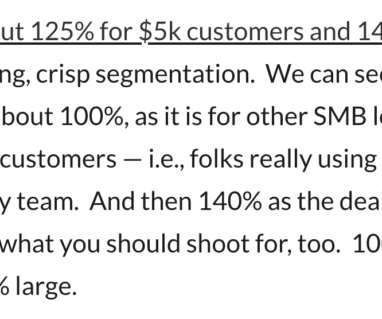

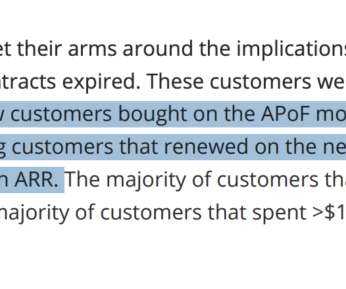

So in theory, SMB SaaS is better than enterprise, at least 9 times out of 10: Deals close much faster. But beyond all the other Pros and Cons of SMB vs enterprise, there’s one looming issue with SMB SaaS: Churn. Endemic churn. The type of churn you almost can’t do anything about.

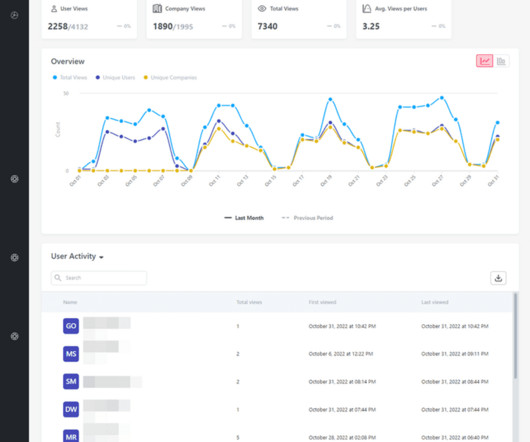

Let's personalize your content