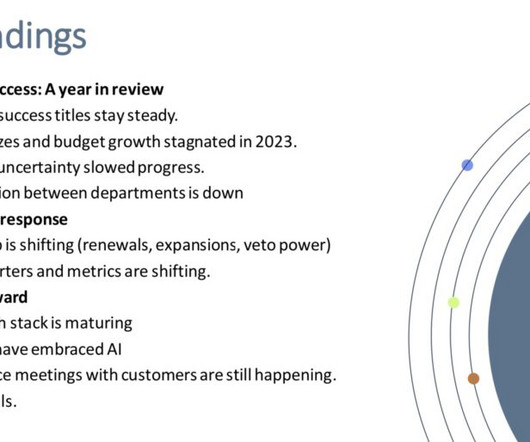

The Typical Startup Saw a 24% Increase in Sales Cycle in 2023

Tom Tunguz

MARCH 27, 2023

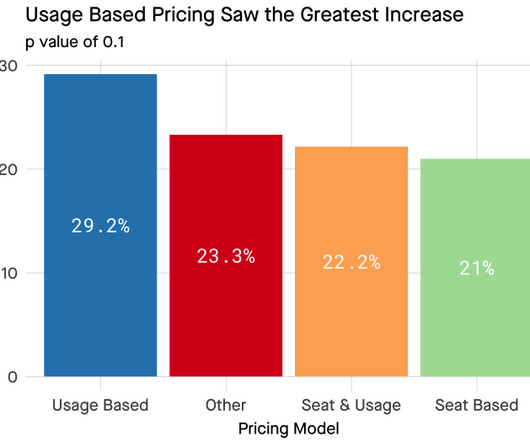

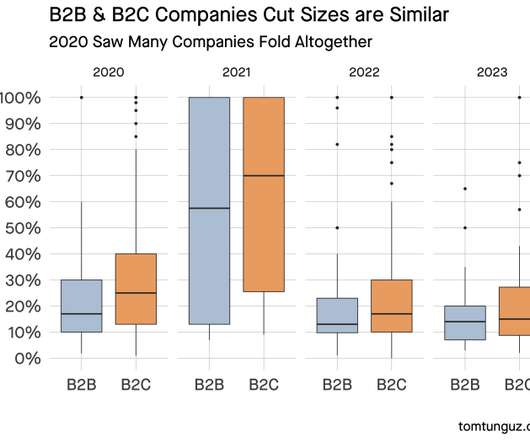

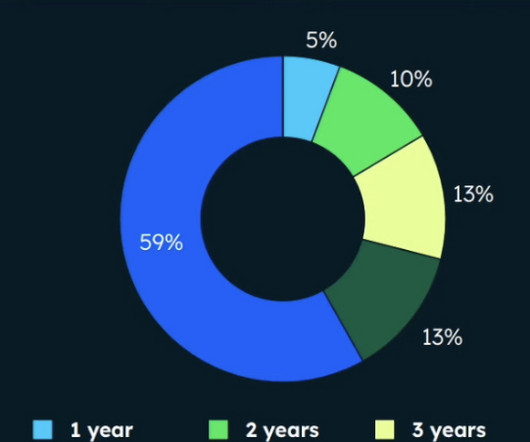

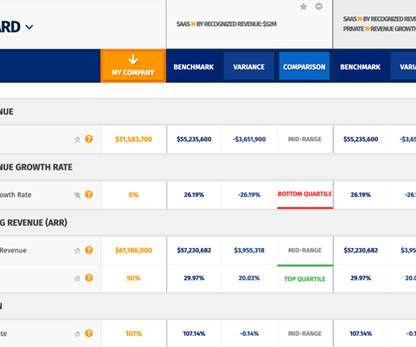

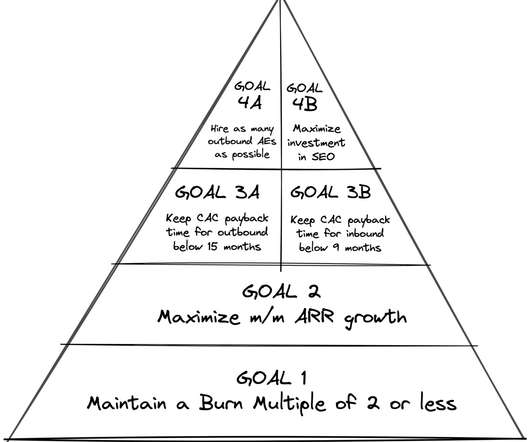

Sales cycles shifted dramatically in 2023. Slower sales cycles create pipeline shocks & startups are feeling the impacts. The average startup saw a 24% increase in sales cycle from early 2022 to 2023. 60 day sales cycles are now 75 days. But the latency isn’t evenly distributed.

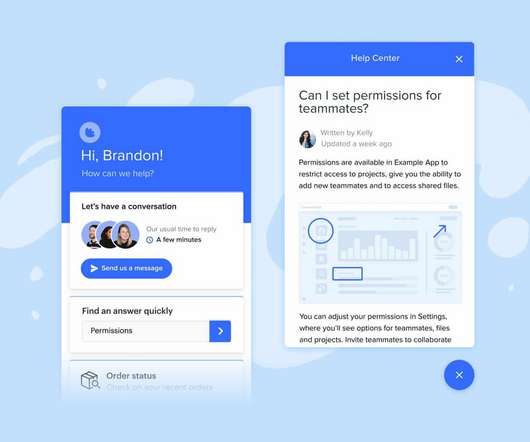

Let's personalize your content