5 Interesting Learnings from Blackbaud at $1 Billion in ARR

SaaStr

MARCH 29, 2023

and IPO’d in 2004 (!), and transitioned into SaaS later and through acquisitions, and then into a broad platform for fundraising and educational management. $100 Increased Transaction Fees and Raised Prices on Renewals. Like Blackbaud. It’s a real oldie in educational and nonprofit software. It was founded in 1981 (!)

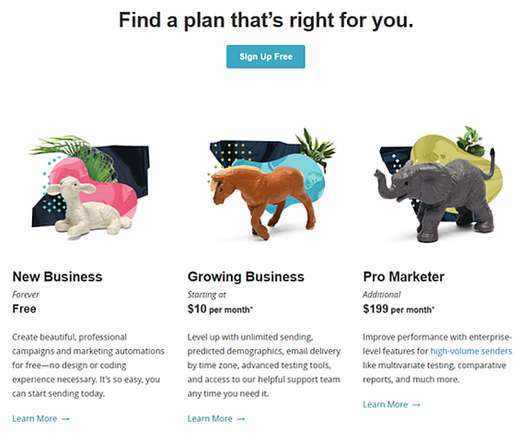

Let's personalize your content