The End of Customer Success As We Knew It

SaaStr

DECEMBER 23, 2023

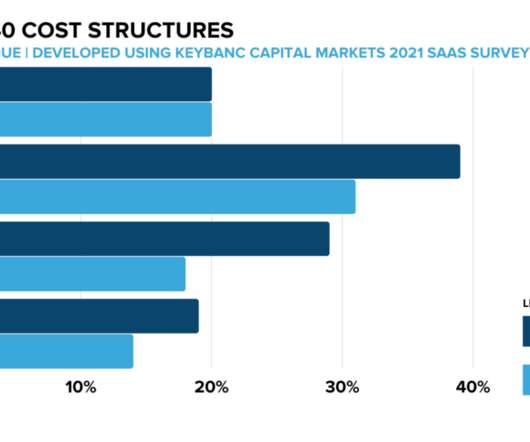

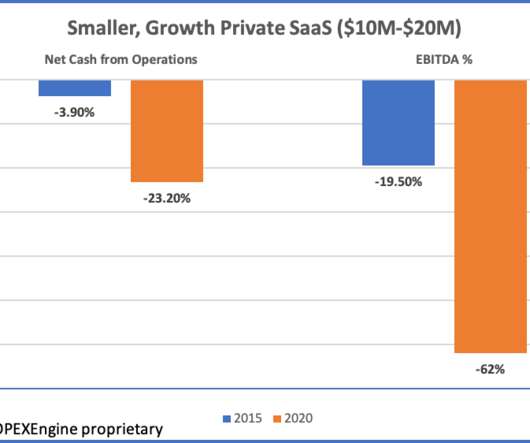

The Massive Push to Efficiency As almost every public SaaS company got cash-flow positive and radically more efficient, and most startups had to stretch their dollars much further — customer success took a lot of the brunt. So be it, but that left even fewer resources and attention on just plain … customer success.

Let's personalize your content