The Riskiest Venture-Backed Startups Are 3H’s: High Growth, High Churn and High Burn

SaaStr

MARCH 8, 2024

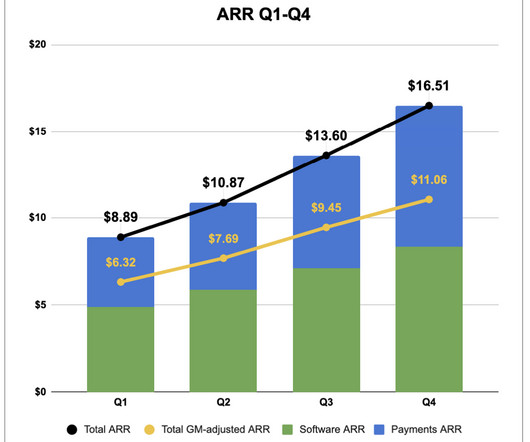

Don’t disguise it in growth and/or venture capital. They weren’t a 3H startup. SaaS + hardware, SaaS + payments, etc. But they often have much lower gross margins than pure software. That means you can probably fix this situation — if you act soon enough: Relentlessly attack churn. can be great.

Let's personalize your content