Fake Multi-Product vs. Real Multi-Product

SaaStr

JANUARY 1, 2024

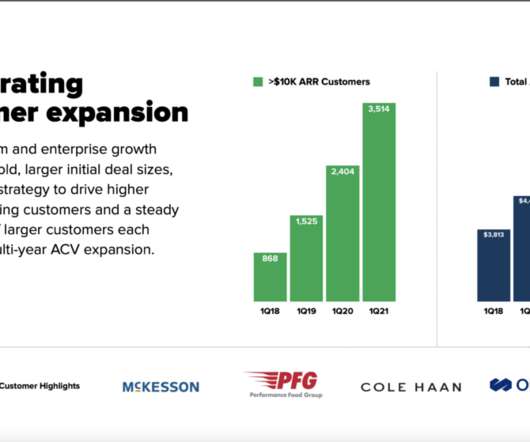

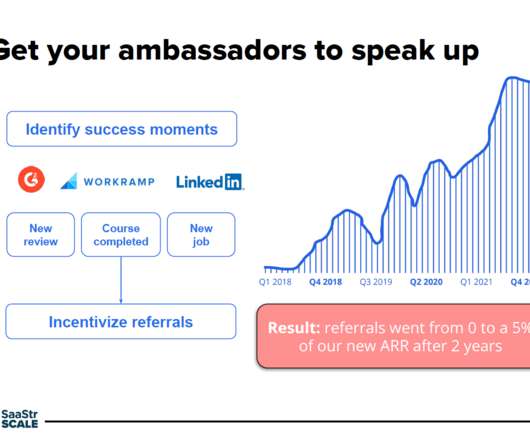

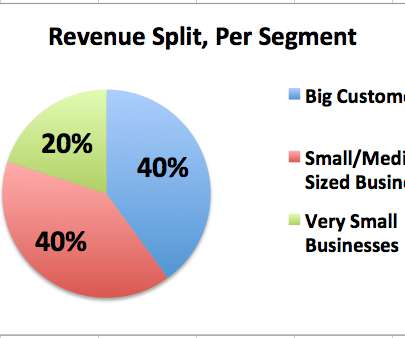

Sometimes by as early as $20m ARR, sometimes by as late at $200m ARR, or later. An add-on can drive up the ACV of your customer, and that’s important to scale. The post Fake Multi-Product vs. Real Multi-Product appeared first on SaaStr. But net net, the average public SaaS compay has 35,000 customers.

Let's personalize your content