A Look Back at Q4 '23 Public Cloud Software Earnings

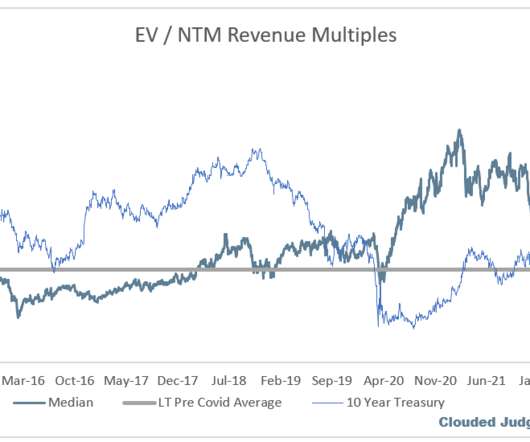

Clouded Judgement

APRIL 11, 2024

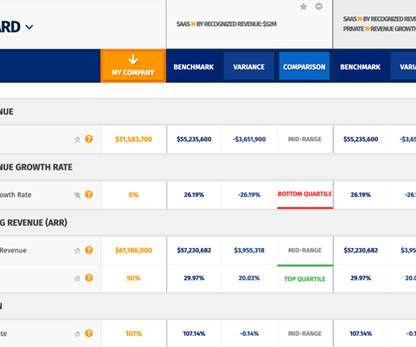

Through these interactions, I’ve built up mental benchmarks for metrics on which I place extra emphasis. net retention and CAC payback). This has all resulted in the median stock price declining 5% YTD. Not surprisingly, these benchmarks match up relatively well with the numbers public companies reported.

Let's personalize your content