The Capex Conquest in the Cloud

Tom Tunguz

APRIL 30, 2024

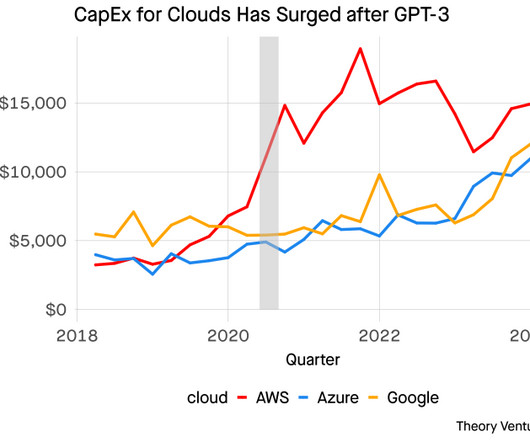

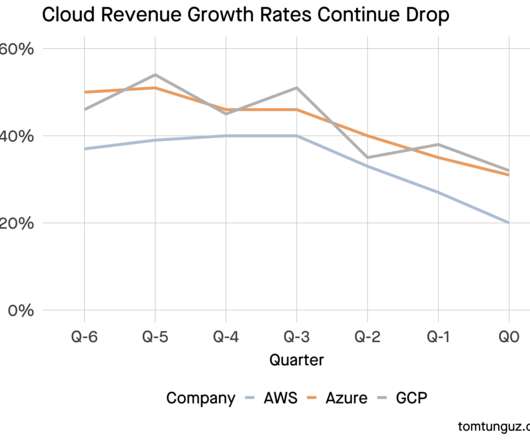

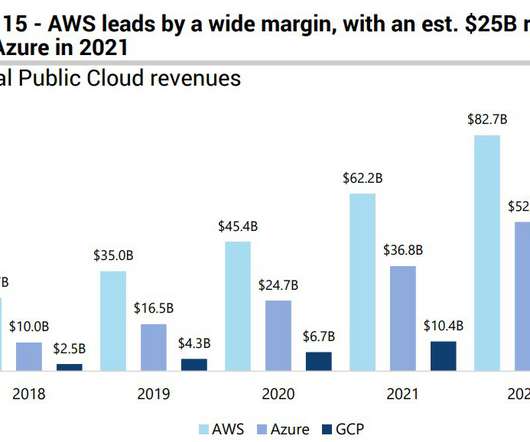

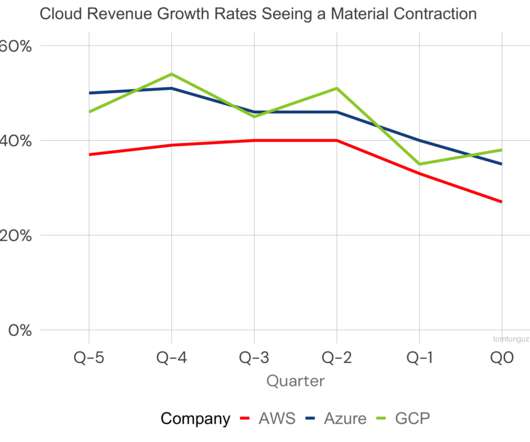

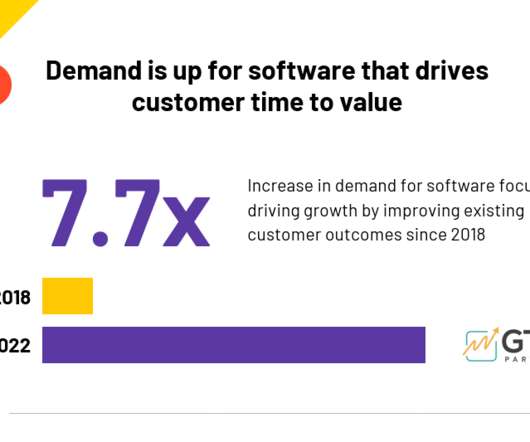

Aside from the overall growth of these clouds increasing, the massive investment in CapEx data centers, power plants, and GPUs is stunning. ” And those margins are increasing for the clouds, which should catalyze more companies, especially the largest spenders, to think about managing their own infrastructure.

Let's personalize your content