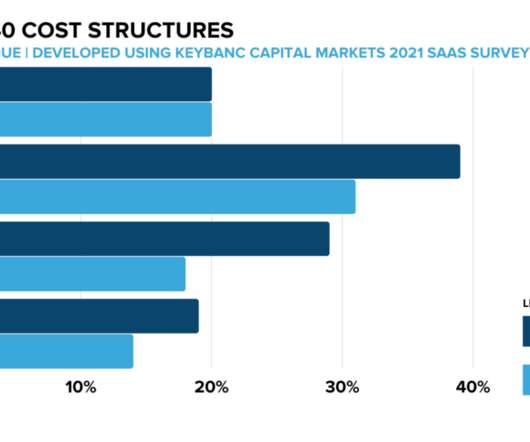

SaaS Rule of 40 Drivers Using KeyBanc’s 2021 SaaS Survey

SaaStr

NOVEMBER 4, 2021

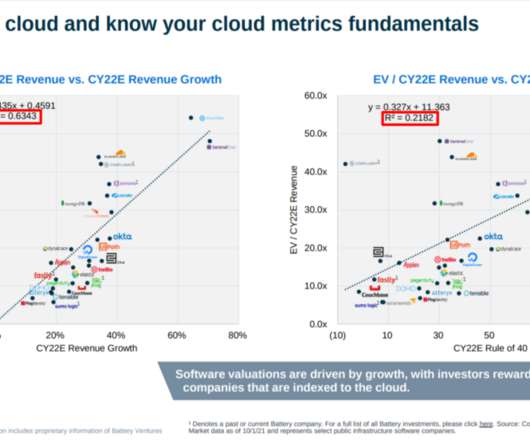

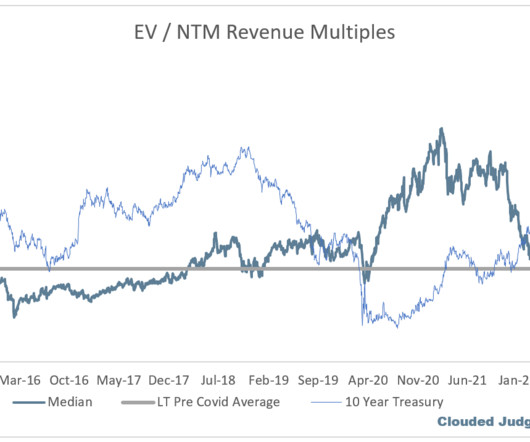

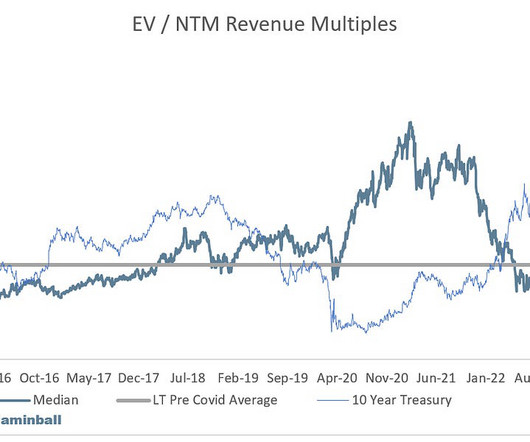

The “Rule of 40” is one of the most commonly cited valuation benchmarks in SaaS for both public and private companies. The SaaS “Rule of 40” has gained popularity due to its simplicity, requiring only two common financial metrics to be added together. After all, 31% + 29% = 60%.

Let's personalize your content