A closer look at the 6 things to pre-empt 90% of Due Diligence

The Angel VC

MAY 8, 2015

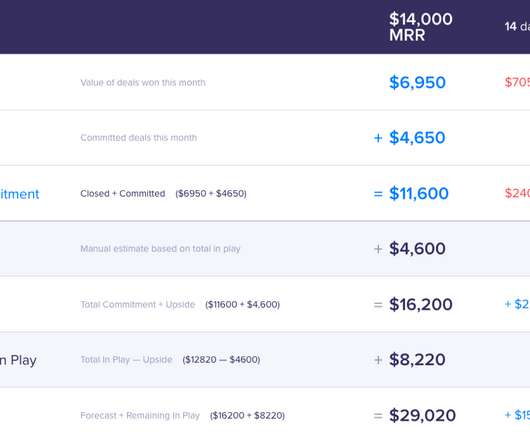

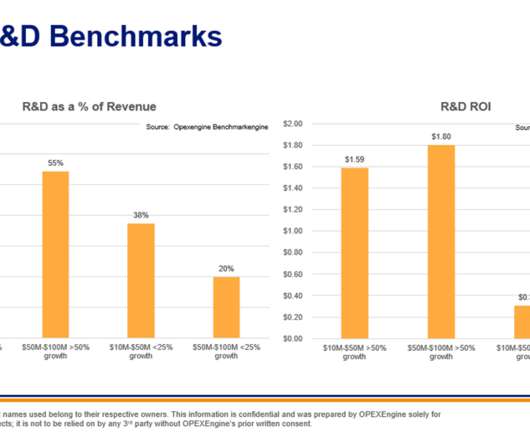

Since last week's post about 6-7 things to pre-empt 90% of Due Diligence was liked/shared/retweeted quite a bit, I'd like to follow up with some additional details on what exactly SaaS Series A/B investors will look for when you supply them with the data and material that I've mentioned. Typically this metric is in the 1-5% range.

Let's personalize your content