Integrated Payments vs. Payfac-as-a-Service: What Developers Need to Know

USIO

FEBRUARY 13, 2024

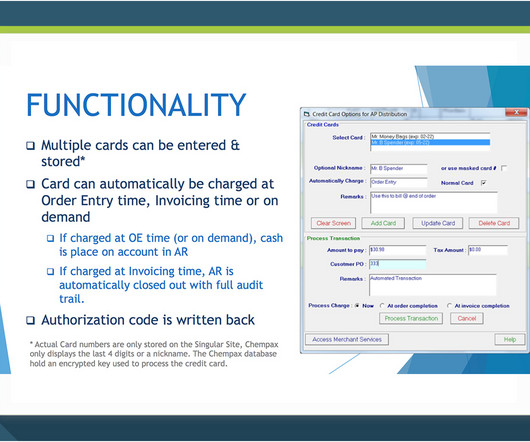

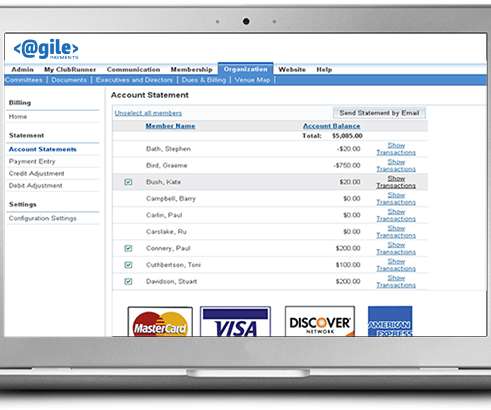

Two prominent solutions that have emerged in recent years are integrated payments and Payfac-as-a-Service. Payfac-as-a-Service: Payfac-as-a-Service, short for Payment Facilitator as a Service, is a model where a third-party service provider facilitates payment processing on behalf of multiple sub-merchants.

Let's personalize your content