SaaS Churn: Myths, Benchmarks, and Strategies to Retain More Revenue

FastSpring

APRIL 26, 2022

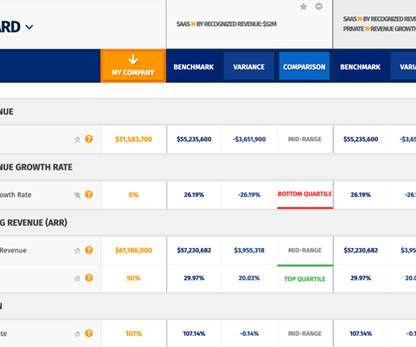

In part one, we cover benchmarks and common churn formulas. Part I: SaaS Churn Benchmarks Part II: 5 Proven Strategies for Reducing SaaS Churn Part III: Churn Definitions and Additional Resources. Part I: SaaS Churn Benchmarks. When we set churn benchmarks for SaaS companies, there’s so much to consider.

Let's personalize your content