A Look Back at Q1 '25 Public Cloud Software Earnings

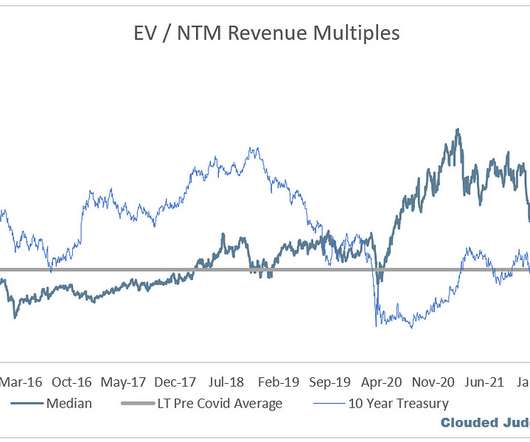

Clouded Judgement

JUNE 17, 2025

My hope is that this analysis can provide startup entrepreneurs with a framework for how to manage their businesses around SaaS metrics (e.g., net retention and CAC payback). FCF Margin FCF is an important metric to evaluate in SaaS businesses. Net new ARR added was down 28% from Q1 last year.

Let's personalize your content