Clouded Judgement 12.1.23 - Net New ARR Starts to Rebound + AWS ReInvent Recap

Clouded Judgement

DECEMBER 1, 2023

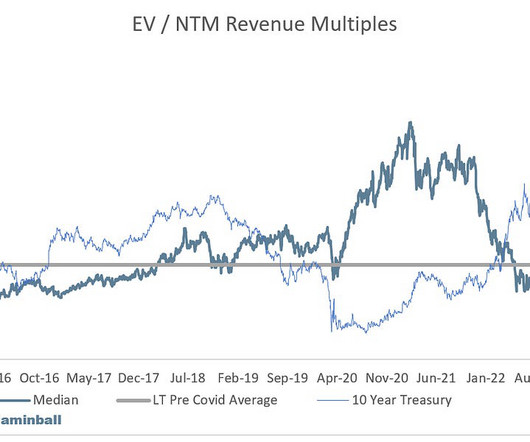

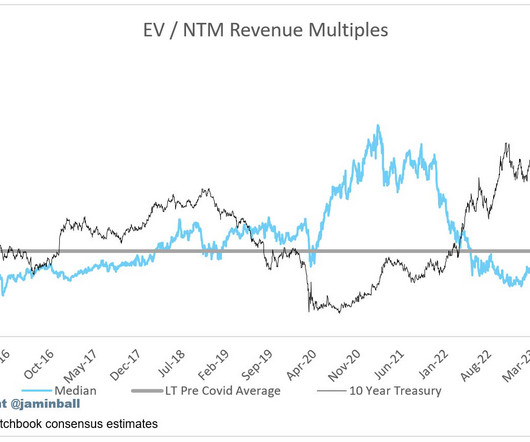

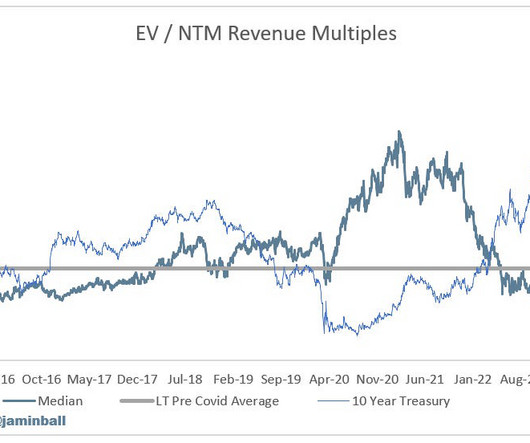

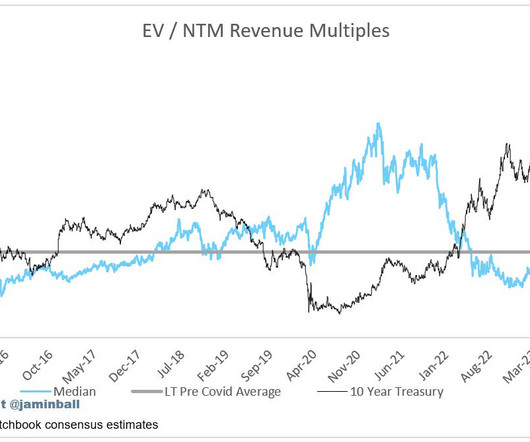

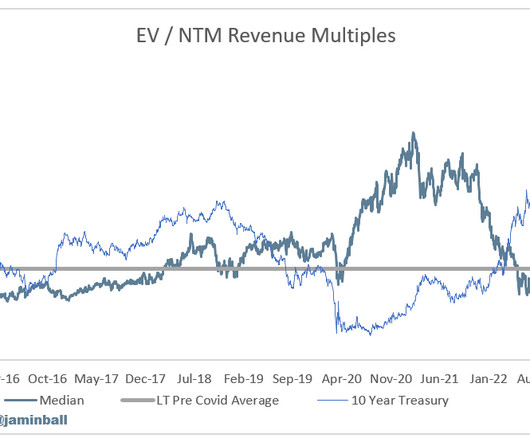

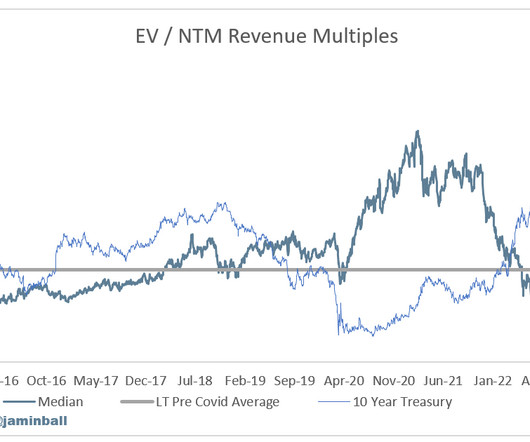

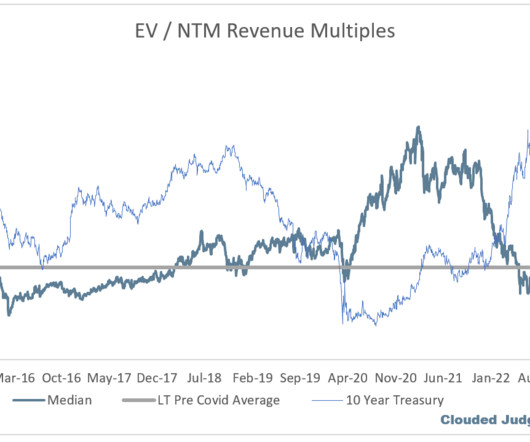

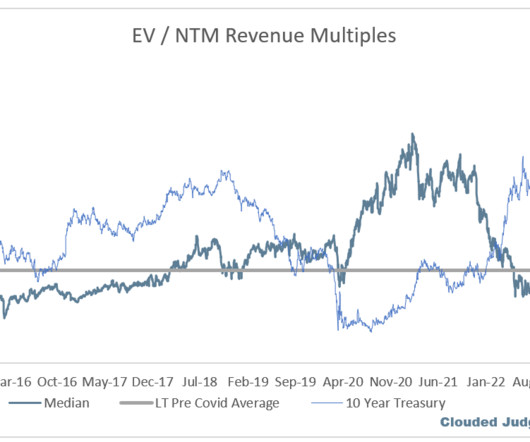

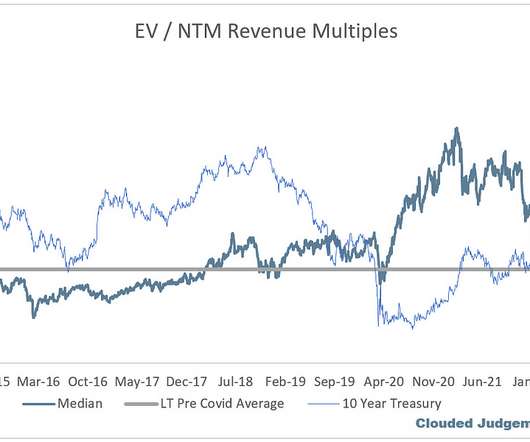

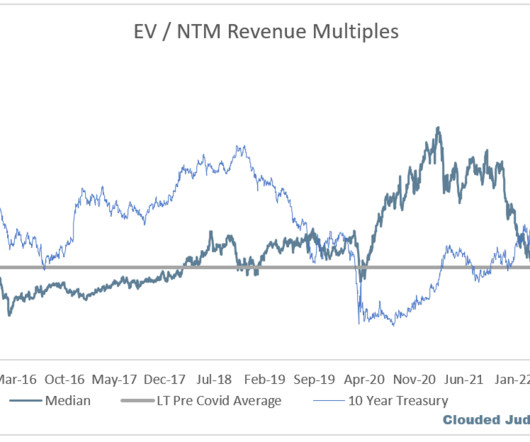

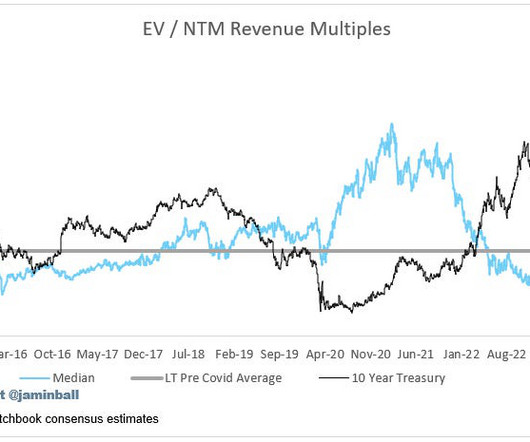

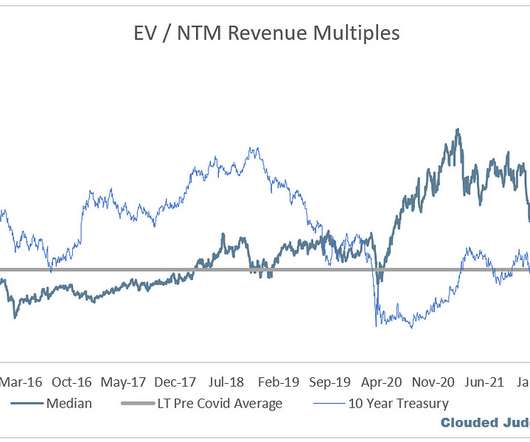

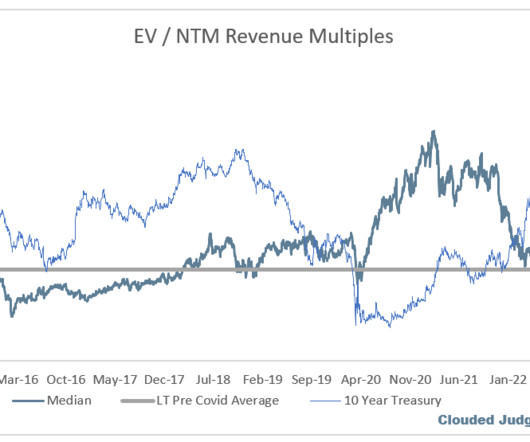

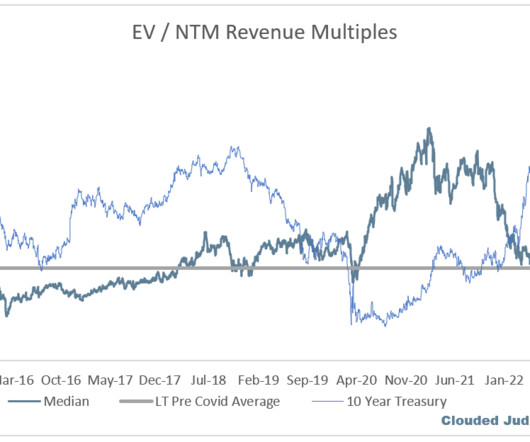

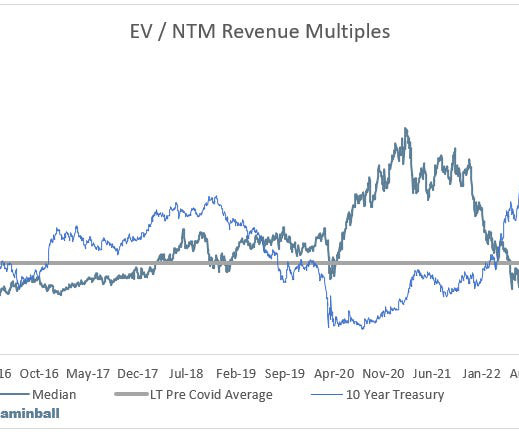

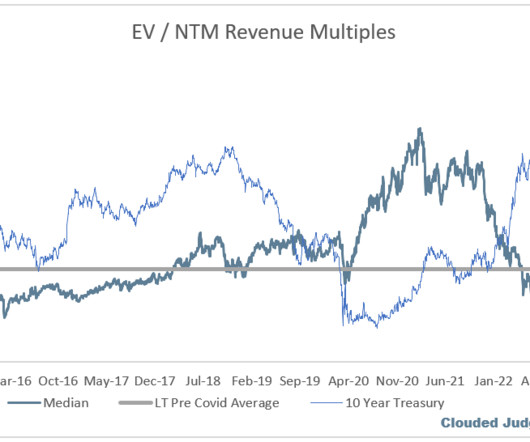

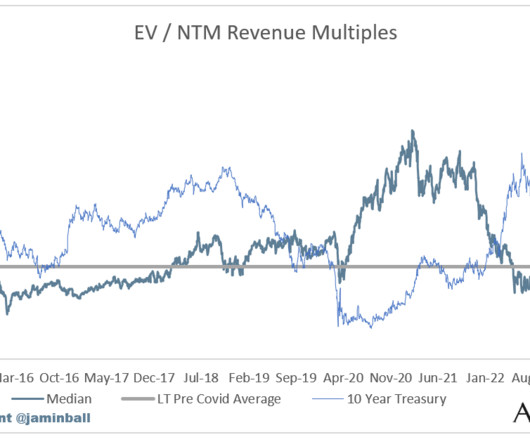

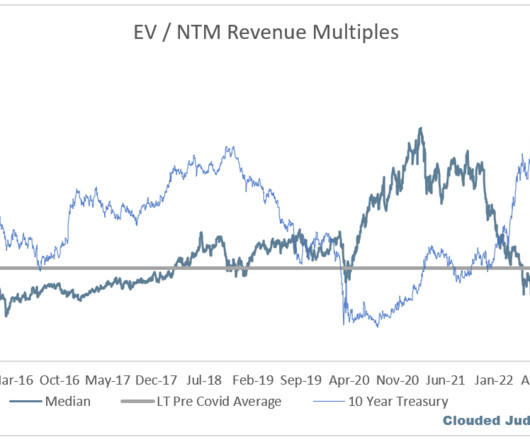

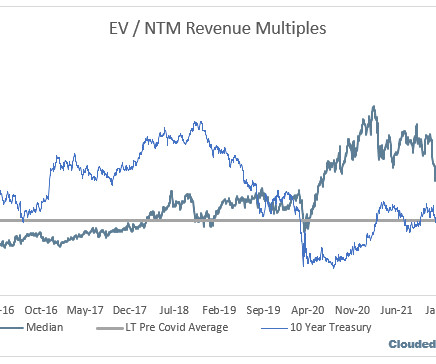

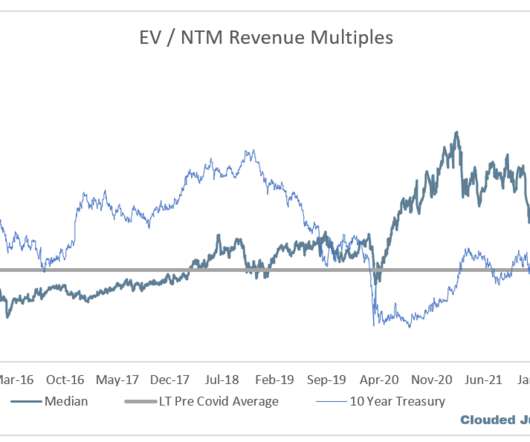

Subscribe now Amazon ReInvent This week Amazon had their annual AWS ReInvent conference. ” AWS fully embracing the breadth over depth approach. Looking at the mid to long term, we feel very optimistic about the outlook for strong AWS growth. Revenue multiples are a shorthand valuation framework. Top 5 Median: 16.6x

Let's personalize your content