Top SaaStr Content for the Week: VMware, AWS and Databricks, GUIDEcx’s Co-Founder and VP of Sales, Workshop Wednesday, sessions from SaaStr APAC and more!

SaaStr

MARCH 26, 2023

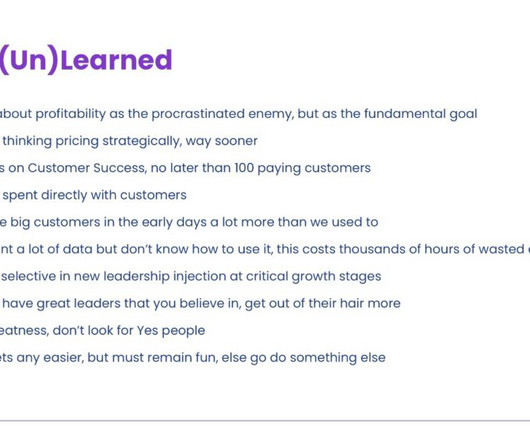

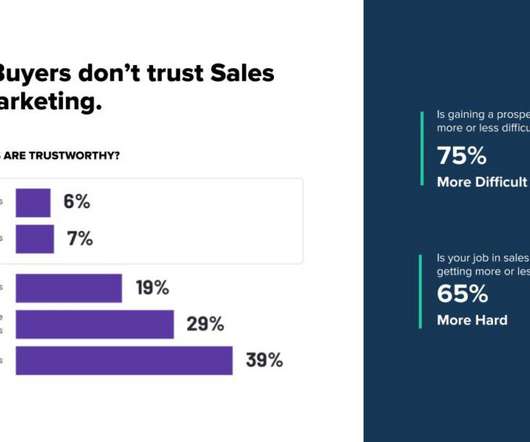

SaaStr 644: Lessons Learned in Scaling Early-Stage to Hyper-Growth Companies: From VMware, AWS and Databricks with Databricks SVP and GM Ed Lenta 2. SaaStr 642: Founder-Led Enterprise Sales: Failure Points on the Path to $100m ARR 5. LIVE Workshop Wednesday with GGV Capital: Scaling The Top SMB SaaS Companies 5.

Let's personalize your content