Shopify Says eCommerce is Back. But AWS Says Cloud Under More Scrutiny.

SaaStr

OCTOBER 28, 2022

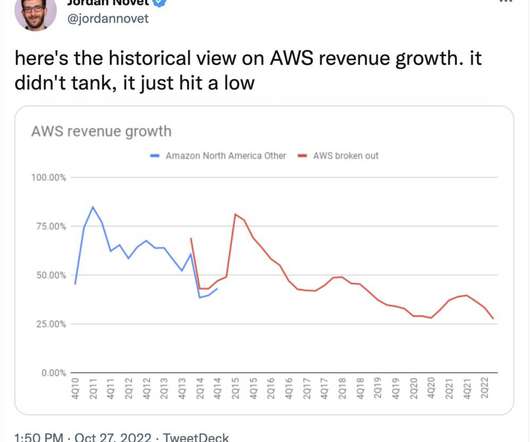

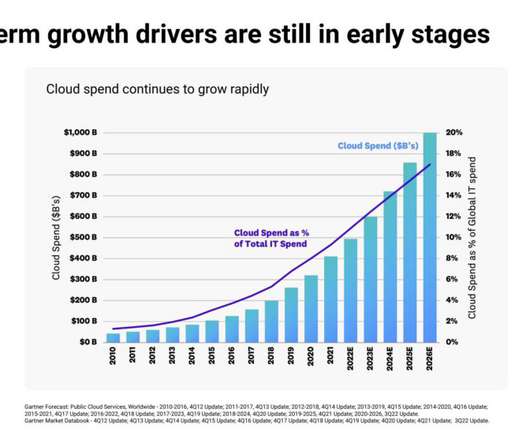

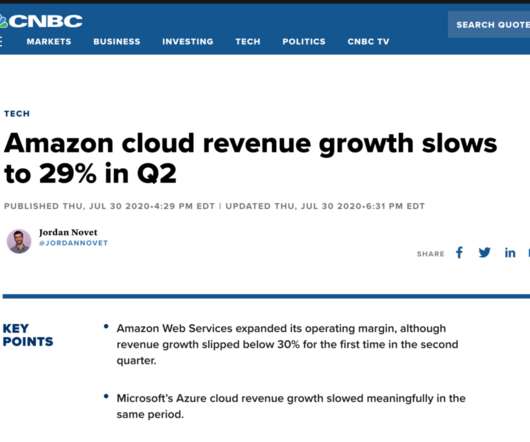

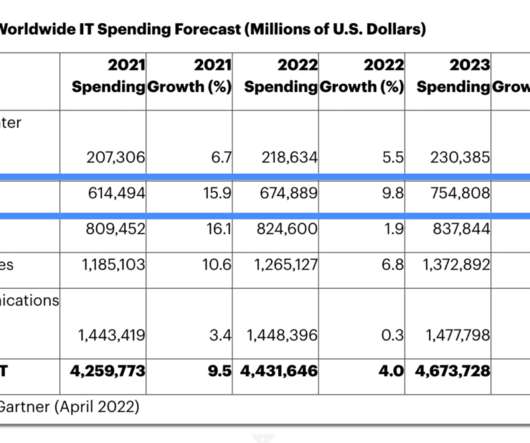

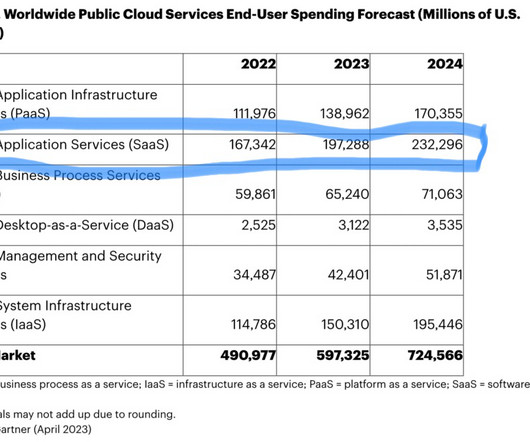

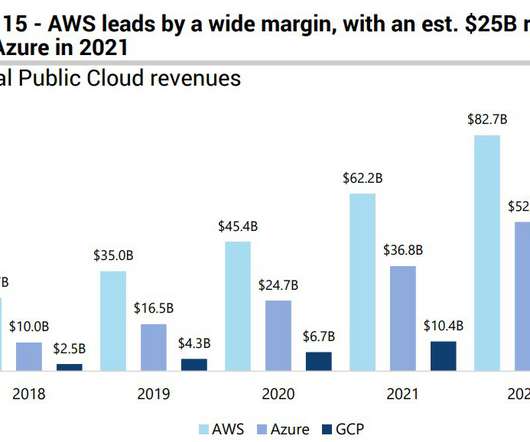

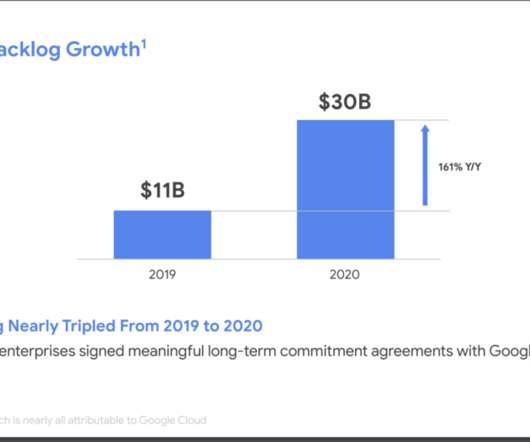

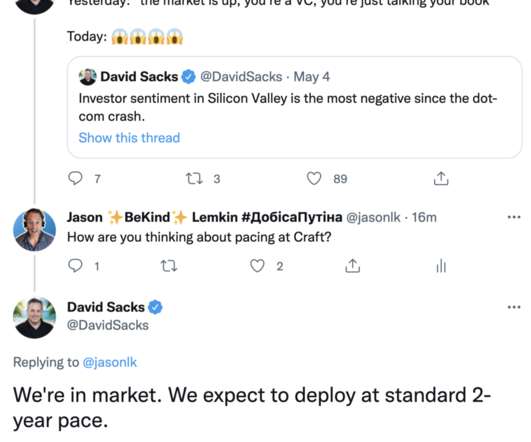

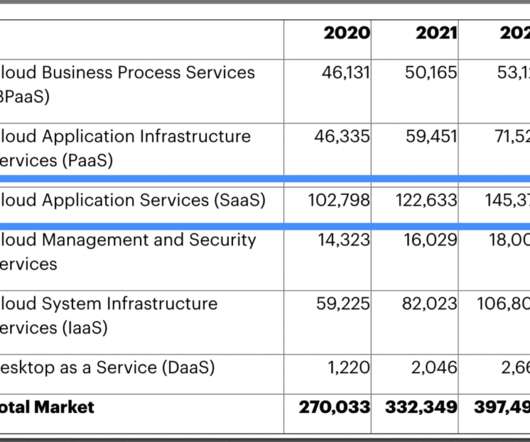

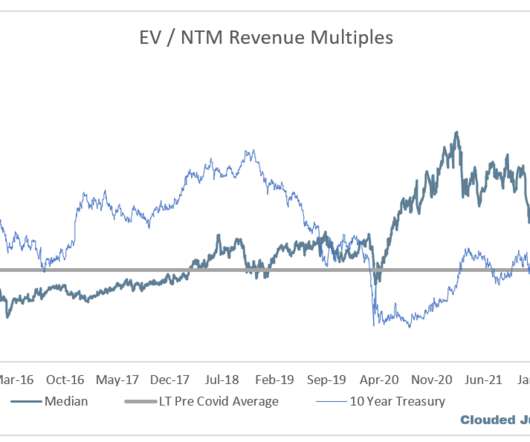

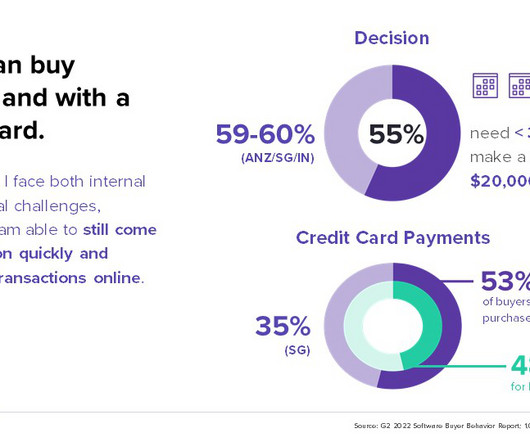

Second, AWS, Azure and Google Cloud all grew nicely, and are still growing like a weed — but the growth rate slowed. AWS and Microsoft Azure all reported more customers scrutinizing spend and working to manage their bills more carefully. But AWS Says Cloud Under More Scrutiny. Perhaps as it should be.

Let's personalize your content