Gas Gas Revolution

Tom Tunguz

OCTOBER 26, 2023

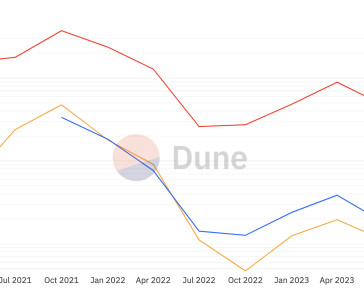

In 2021, Amazon announced they had reduced prices on Amazon Web Services 107 times since launch. This drop in prices has grown AWS into a $90b revenue business in 17 years. In 2021, at the peak, the average quarterly gas fee on Ethereum reached about $37. The cost to save data to a blockchain is called gas.

Let's personalize your content