Raise, Sell, Merge, or Scale? How to Navigate the Market Downturn.

SaaSOptics

AUGUST 11, 2022

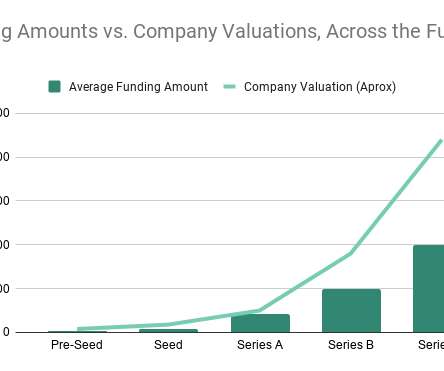

Rising inflation and a weak stock market are causing investors to be more careful with their financing, and without a plan to manage your cash runway effectively, you’re putting both yourself and your company at risk. So what should you do if you’re strapped for cash and have your sights set on venture capital?

Let's personalize your content