Venture Capital, Withering & Dying

Tom Tunguz

FEBRUARY 9, 2023

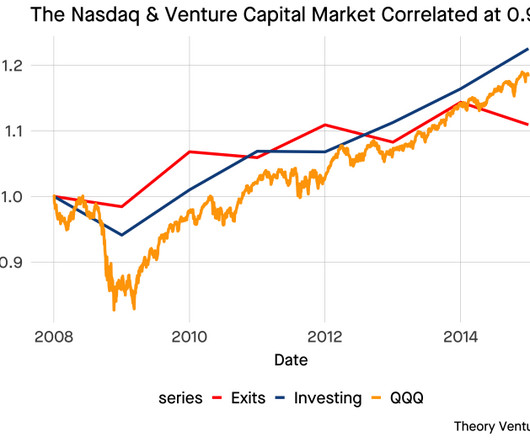

Amy Cortese published “Venture Capital, Withering & Dying” in the New York Times on Oct 21, 2001. There are also fewer mergers and acquisitions. Venture capital funds lost 18.2 In Venture capital investment pace has slowed. 11, investors have become much more discriminating.

Let's personalize your content