Clouded Judgement 1.12.24 - Hard Truths

Clouded Judgement

JANUARY 12, 2024

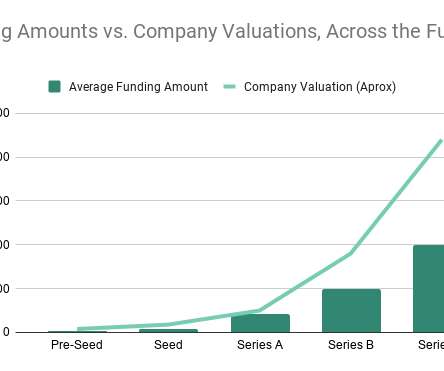

Every type of investor was broadly operating in a “risk on” mindset given the ZIRP environment, and the venture capital ecosystem was no exception. An acquisition at $200m can be life changing for founders, or it can be worth nothing if they raised $250m at $1B valuation back in 2021. This all shifted in 2021.

Let's personalize your content