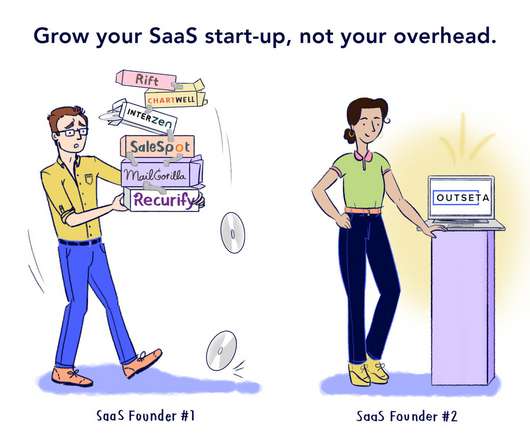

Thanks to Carta, Make, Outreach, SAP, and Worldline for Sponsoring SaaStr Europa 2023!

SaaStr

JUNE 1, 2023

The company is trusted by more than 30,000 companies, over 5,000 investment funds, and half a million employees for cap table management, compensation management, liquidity venture capital solutions, and more. Our vision is a world where everyone has the power to innovate without limits. We are Worldline.

Let's personalize your content