Raising Venture Capital in 2024? The Air is Very, Very Thin Above $200,000,000 Valuations

SaaStr

DECEMBER 29, 2023

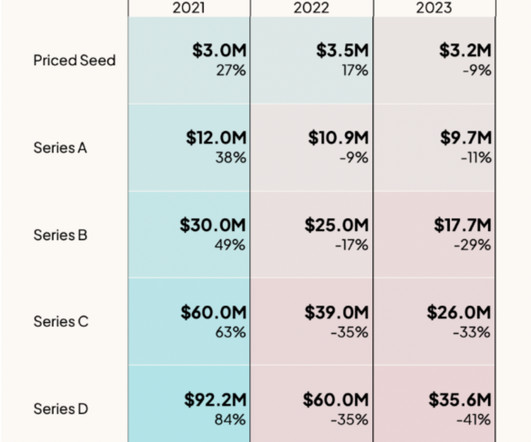

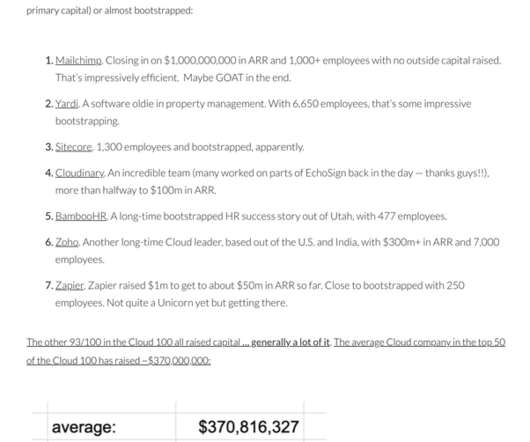

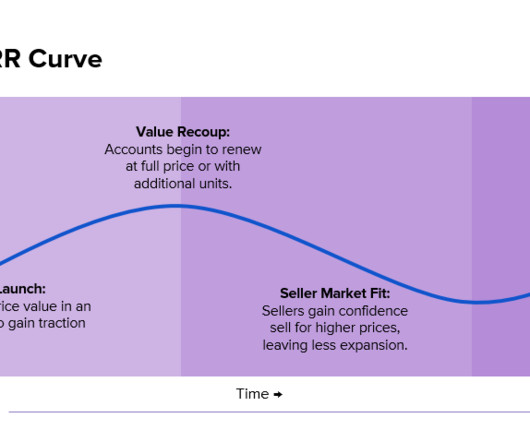

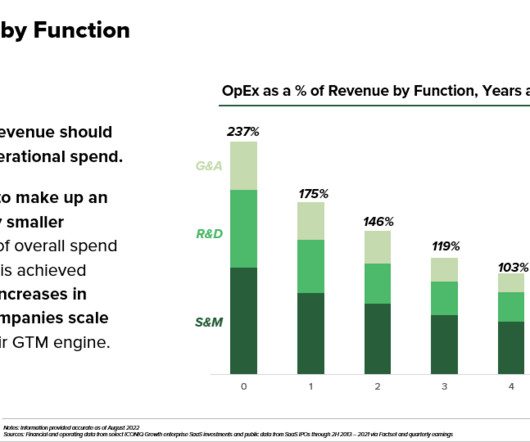

If I had to summarize venture capital today, it would be like this: There is Very Little Oxygen Today Above $200m Valuations What do I mean? It’s still a weird world in venture: Firms are both shutting down and raising new funds. More entrepreneurs are doing direct investing themselves than ever. But Series D? -41%.

Let's personalize your content