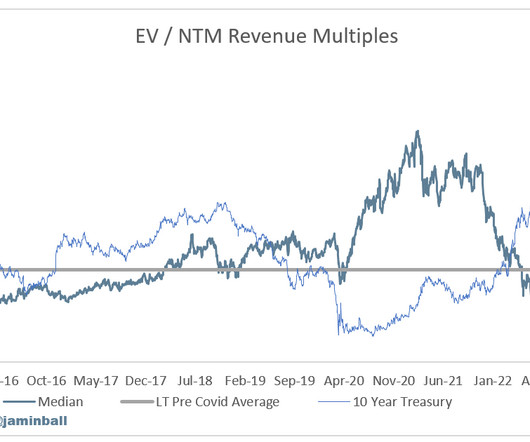

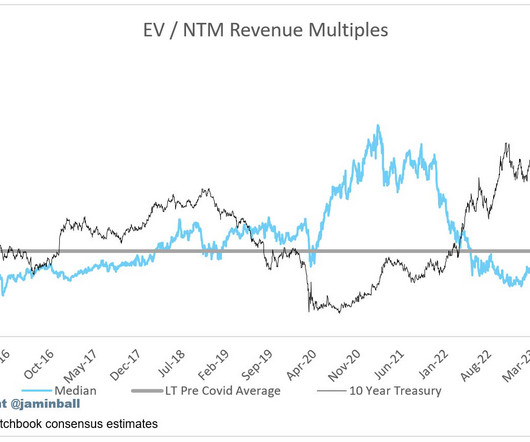

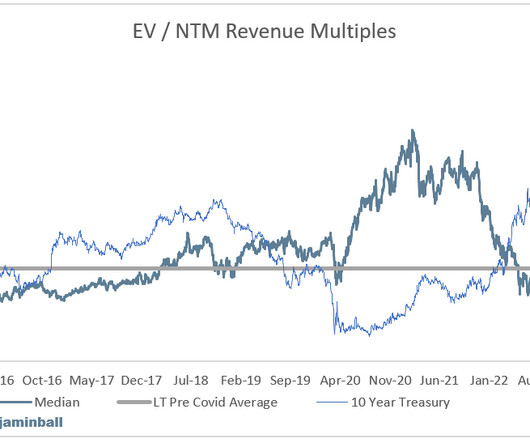

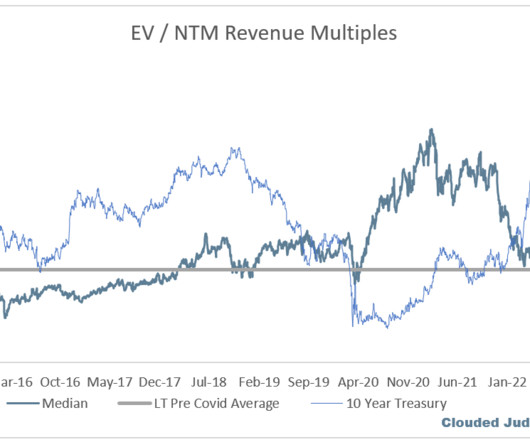

SaaS Multiples Are At a 3+ Year Low. Where It Goes From Here.

SaaStr

MAY 6, 2022

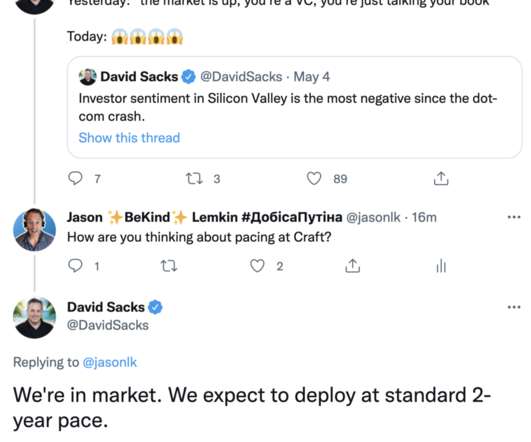

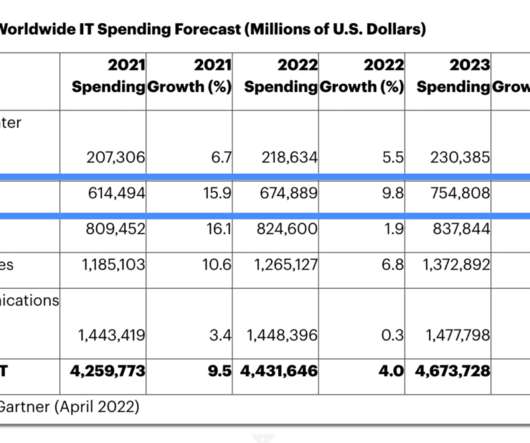

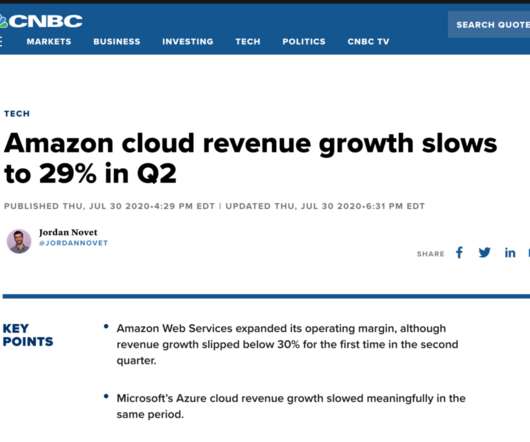

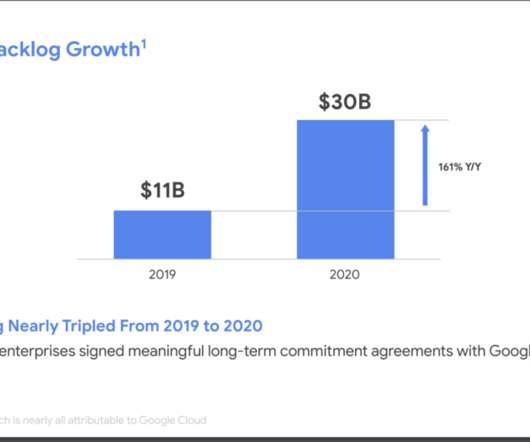

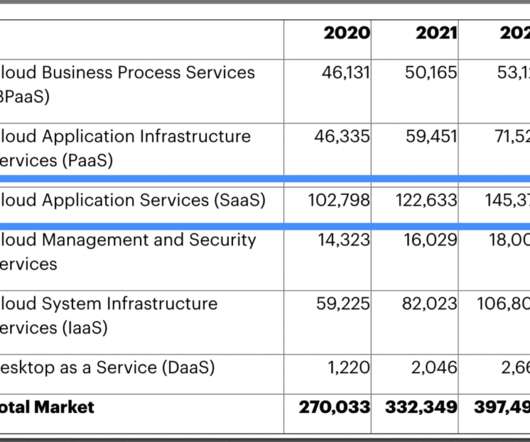

Many SaaS and Cloud leaders are down more than 50% from their all-time highs. A Covid Hangover in SaaS stocks.’ Amazon AWS, Microsoft Azure and even Google Cloud are on fire, adding insane amounts of revenue this year. The top SaaS and Cloud leaders are even accelerating at $1B in ARR, for goodness sakes!!

Let's personalize your content