SaaStr Podcasts for the Week with Keith Rabois and Jason Lemkin

SaaStr

JULY 17, 2020

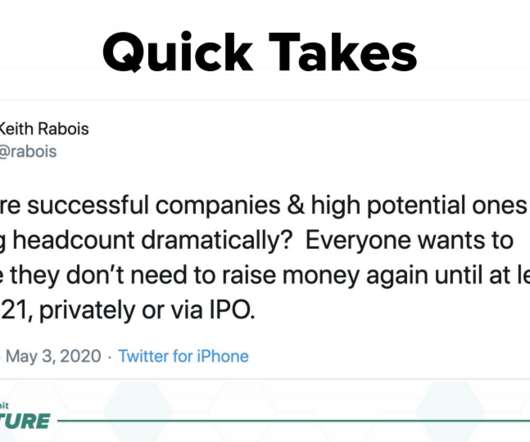

353: Keith Rabois (Paypal, Linkedin, Square) and SaaStr Founder Jason Lemkin talk about the landscape of SaaS & Cloud fundraising and valuation in 2020. This episode is an excerpt from Keith and Jason’s session at SaaStr Summit: The New New in Venture. Does it not all bubble up to even the best cloud stocks? March was rough.

Let's personalize your content