Thanks to Carta, Make, Outreach, SAP, and Worldline for Sponsoring SaaStr Europa 2023!

SaaStr

JUNE 1, 2023

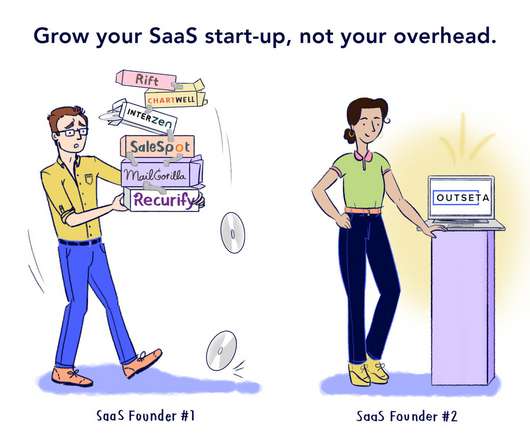

At SaaStr, our partners are an integral part of our events. Carta is a platform that helps people manage equity, build businesses, and invest in the companies of tomorrow. Make enables individuals, teams, and enterprises across all verticals to create powerful custom solutions that scale their businesses faster than ever.

Let's personalize your content