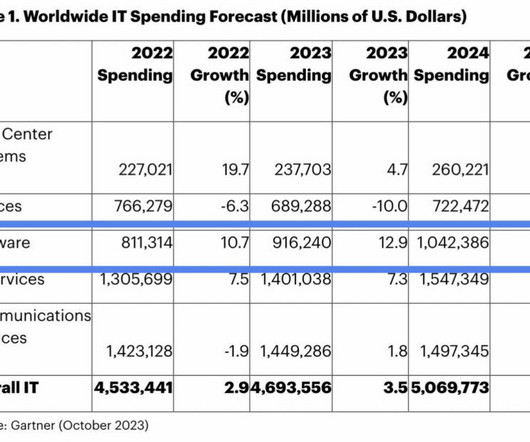

Gartner: Software Spend Will Grow 13.8% in 2024, to Over $1 Trillion For The First Time

SaaStr

NOVEMBER 6, 2023

If you’re selling software to SMB merchants and outside of tech like Shopify and Toast and Monday , things are pretty, pretty good, if in some ways still harder than before. On top of that, inflation and price increases are eating into overall IT budgets. Growth in public cloud services (AWS, Azure, Google Cloud, Snowflake, etc.)

Let's personalize your content