The 40% Problem: Do Your Sales Reps Really Cover All Their Accounts? And Is AI The Answer? With Yamini Rangan, CEO HubSpot

SaaStr

JUNE 4, 2025

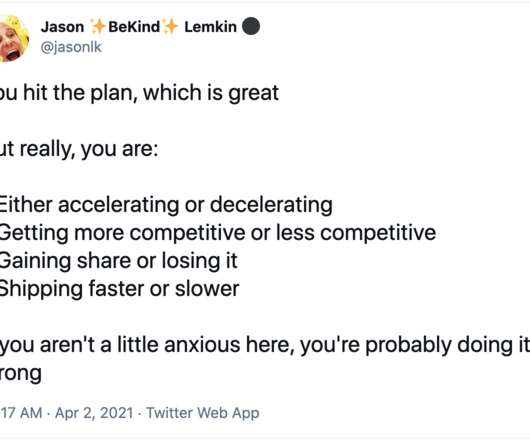

HubSpot CEO Yamini Rangan just laid it bare at a recent conference, and it should make every SaaS leader uncomfortable. A few examples from SaaStr speakers: David Sacks (Craft Ventures, Yammer ) has talked about how, in early-stage SaaS, even with a small sales team, you often see only 50%-60% of assigned accounts getting proper follow-up.

Let's personalize your content