We?re About To See a Lot More SaaS Debt

SaaStr

JUNE 5, 2020

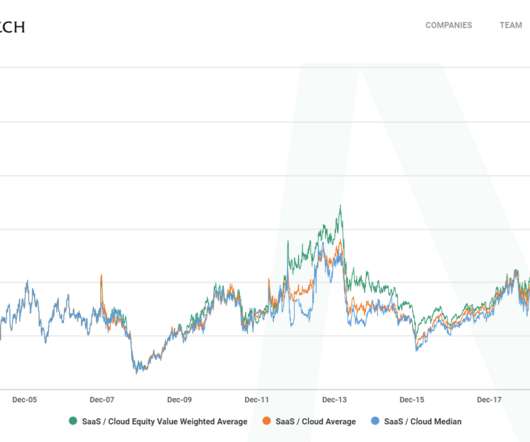

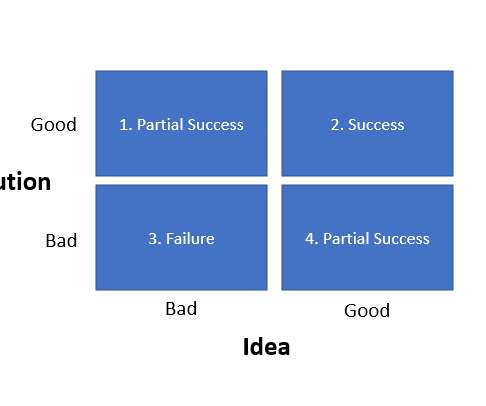

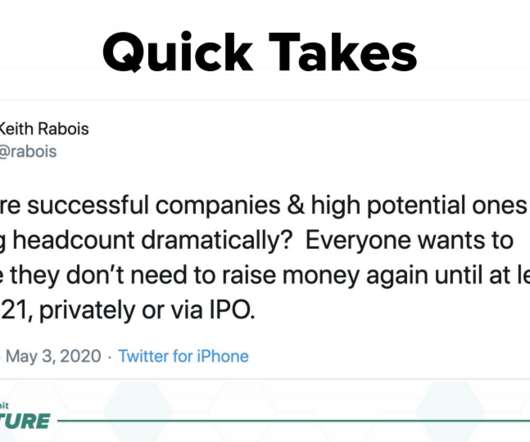

I argue that standard saas metrics make it possible for founders to scale using debt capital (production capital thats cheaper) instead of solely relying on venture capital (financial capital thats more expensive). . 2004 Salesforce IPO Brought Financial Capital to SaaS Founders. Why Let Banks In?

Let's personalize your content