This Message Will Self-Destruct in 33 Seconds

Tom Tunguz

APRIL 3, 2024

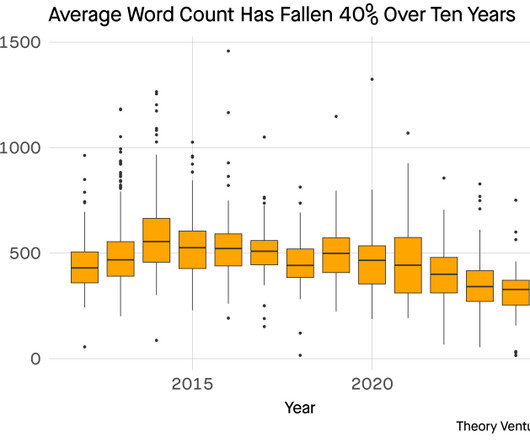

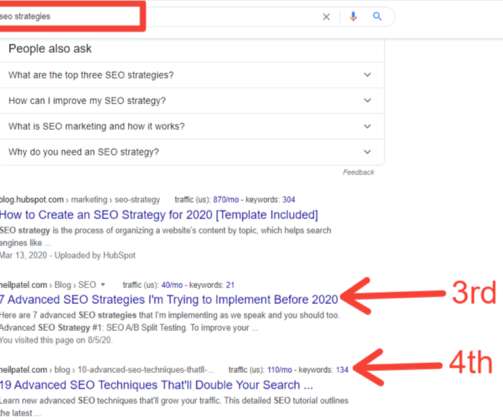

The average American attention span has fallen from 150 seconds in 2004 to 75 seconds in 2012 to 47 seconds in 2023 - a 5-6% annual rate of decline. Year Avg American Attention Span (sec) CAGR 2004 150 - 2012 75 -6% 2023 47 -5% How does this compare to these blog posts? In 2013, the average reader dwelled on this site for 47 seconds.

Let's personalize your content