DAU WAU MAU Metrics: Measuring Active Users In-App

User Pilot

AUGUST 10, 2023

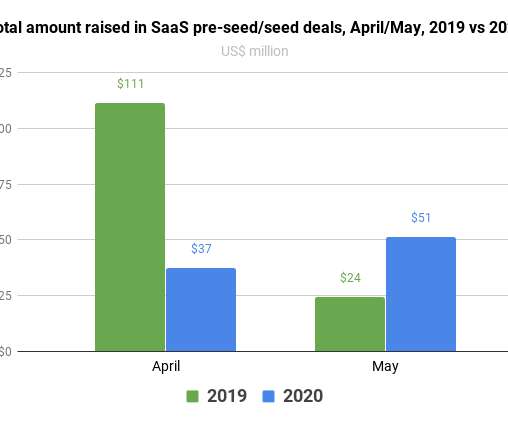

According to venture capital firm Sequoia , the standard DAU/MAU ratio is 10-20%, with only a handful of companies having over 50%. Userpilot can help you… Monitor customer engagement with feature tagging and heatmaps. To calculate DAU, divide your monthly active users by the number of days in the month. Look no further!

Let's personalize your content