The State of SaaS – Global Data Trends from 1000+ Companies with Capchase Co-Founder/CEO Miguel Fernandez and 01 Advisors VP Kristen Clifford (Video)

SaaStr

MARCH 27, 2023

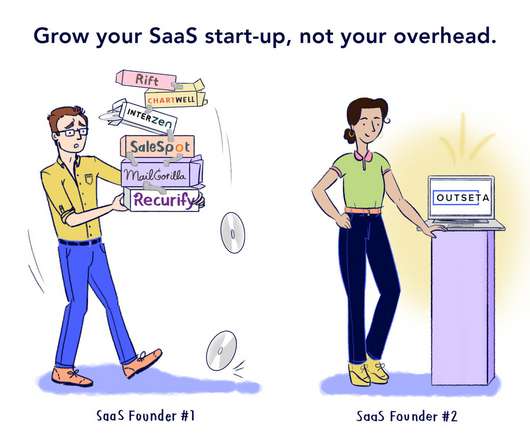

Capchase Co-Founder & CEO Miquel Fernandez and 01 Advisors VP Kristen Clifford use data to show us what differentiates the best SaaS companies from the rest. The top SaaS companies are growing really fast, roughly at twice the rate of their peers. They either raise prices or they don’t give discounts.

Let's personalize your content