Scaling The Top SMB SaaS Companies: What It Takes with GGV Capital Managing Director Jeff Richards and GGV Capital Partner Tiffany Luck (Pod 647 + Video)

SaaStr

APRIL 1, 2023

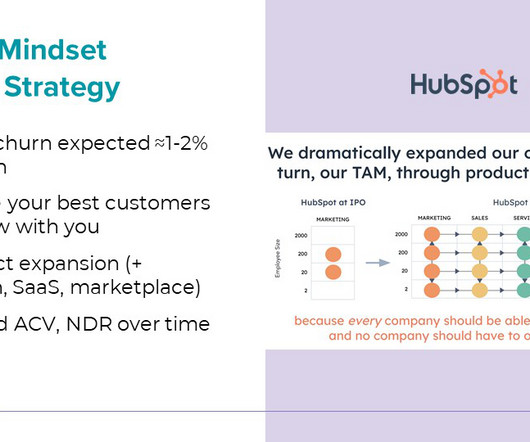

The SMBTech economy is very different from enterprise software, and there is massive opportunity to capture it. Throw in the rise of social media and mobile web payment systems like Stripe and Braintree, and something revolutionary was at our doorstep. Efficient Go To Market There are a lot of ways to GTM as an SMB.

Let's personalize your content