10+ Ways A Venture Financing Can Implode Post-Term Sheet

SaaStr

JUNE 28, 2022

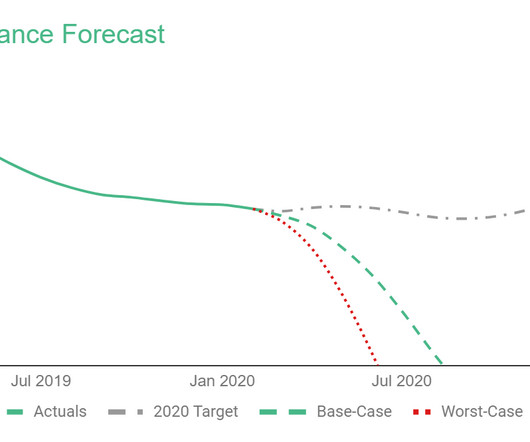

Missing your financial plan in the middle of a financing. And as frustrating as it may be to hear, it’s a fair reason in many cases not to proceed with a venture financing. And any odd stuff on the cap table, or existing terms — at least highlight them, and come with a solution. Not let it evaporate.

Let's personalize your content