10+ Ways A Venture Financing Can Implode Post-Term Sheet

SaaStr

JUNE 28, 2022

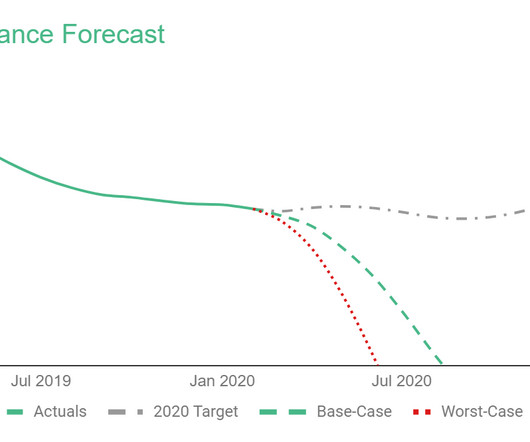

Missing your financial plan in the middle of a financing. While startups have ups and downs, if you tell the VCs you’re going to hit $250,000 in revenue this month … make 100 percent sure you hit that projection. At least, just that one month during the funding process. This happens all too ofte n. Sometimes that’s fine.

Let's personalize your content