M&A Is Back! Melio’s $2.5B Exit to Xero — In Just 7 Years!

SaaStr

JUNE 25, 2025

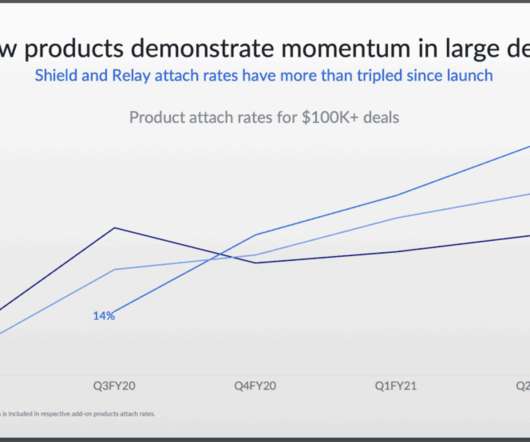

to dominate US SMB payments. revenue multiple proves strong B2B companies with real growth (and it’s strong) can still command premium exits. The deal shows acquirers are hungry for revenue acceleration—Xero expects to more than double group revenue by 2028 with this acquisition.

Let's personalize your content