SaaS Is Growing Up: 4 Business Model Changes To Adopt with Notion Capital

SaaStr

SEPTEMBER 19, 2023

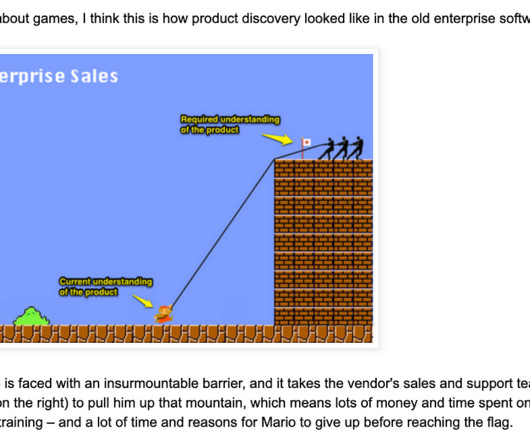

Many of the fundamental business models that were once engraved in the SaaS playbook are now changing thanks to a tougher macro environment and a maturing market. PST, Stephanie Opdam, Partner at Notion Capital, shares four business model changes that will allow SaaS companies to build resilience and staying power over time.

Let's personalize your content