TAM is Great. But What Really Matters is That You Believe You Can Hit $100m ARR in 7 Years.

SaaStr

FEBRUARY 22, 2023

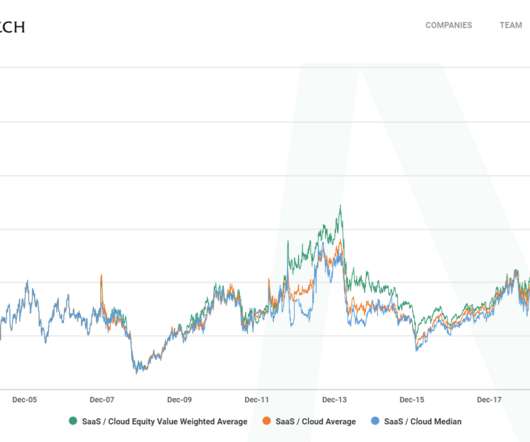

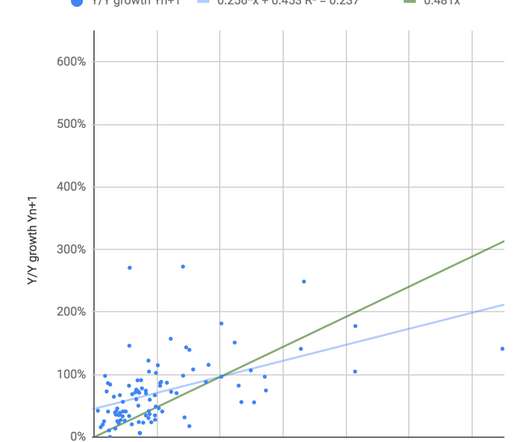

And the model said we’d need it … It also showed me that, barely, if you squinted, and the market grew just right … by 2013, there’d be $100m in ARR in our space. Worth hiring a sales team, raising some venture capital (even a modest amount). And so it is, although we didn’t capture 100% of it.

Let's personalize your content