How to Find the Best SaaS Billing Platform: A Complete Guide

Stax

FEBRUARY 28, 2024

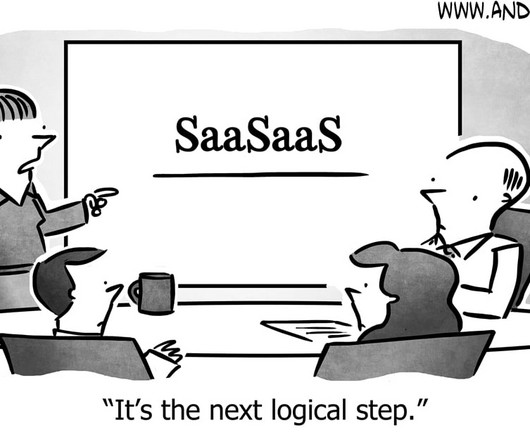

Software-as-a-service (SaaS) businesses need to constantly evolve their offerings to stay fresh and relevant. But if you’re a B2B solution, there’s a high likelihood that businesses will be interested in being able to accept customer payments, rather than just sending them a PayPal link or to a generic payment gateway.

Let's personalize your content