5 Interesting Learnings from Shopify at $6.8 Billion in Revenues

SaaStr

OCTOBER 11, 2023

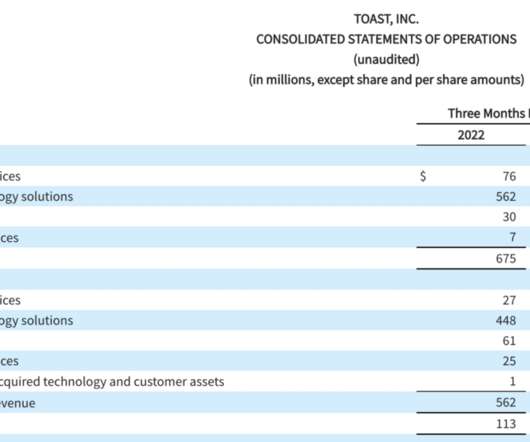

That’s not just pretty epic growth at almost $7 Billion in revenue, it’s one heck of a comeback. But a Smaller and Smaller Percentage of Revenue. From a business model perspective, Shopify has in essence been a fintech and merchant product first and a SaaS product second for quite some time. A tough transition.

Let's personalize your content