5 Interesting Learnings from Squarespace at $700,000,000 in ARR

SaaStr

APRIL 17, 2021

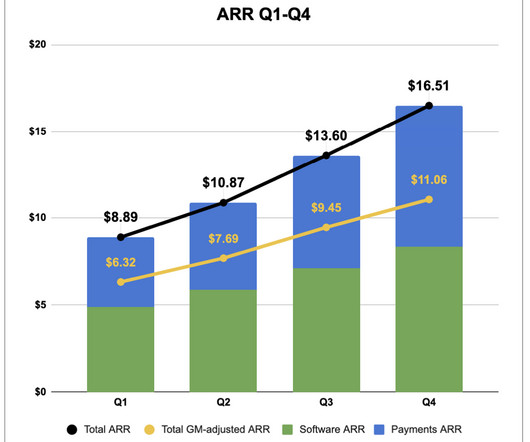

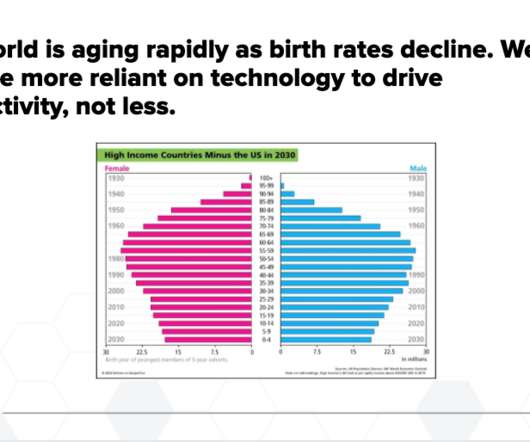

Over $500,000 revenue per employee. Monetizing ecommerce via subscriptions, but not payment processing. Billion in GMV processed, up a stunning 91% from 2019. Billion in GMV processed, up a stunning 91% from 2019. Rather, it charges for software subscriptions to take payments on its websites.

Let's personalize your content