How an Estonia-based SaaS Grew to €10M ARR by Expanding Across 3 Continents?

FastSpring

APRIL 7, 2022

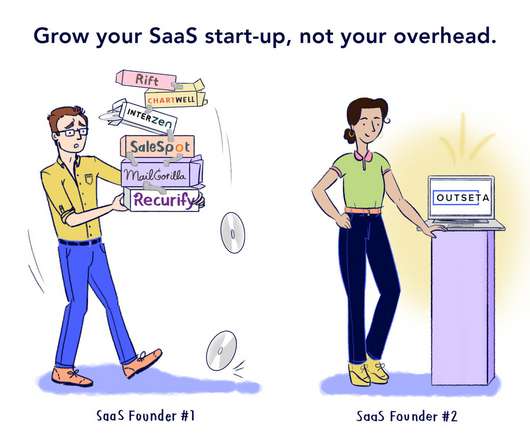

Learn more about how FastSpring helps SaaS and software companies collect and remit taxes globally or localize and accept global payments. Messente is a global messaging SaaS that helps companies send SMS messages and PIN codes in countries around the world. Note: If you’re expanding to new regions, we can help.

Let's personalize your content