Clouded Judgement 2.29.24 - Shades of 2021

Clouded Judgement

MARCH 1, 2024

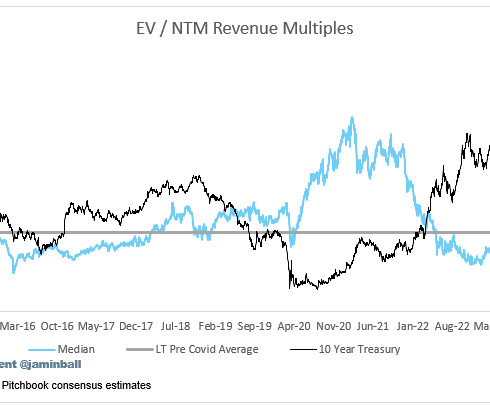

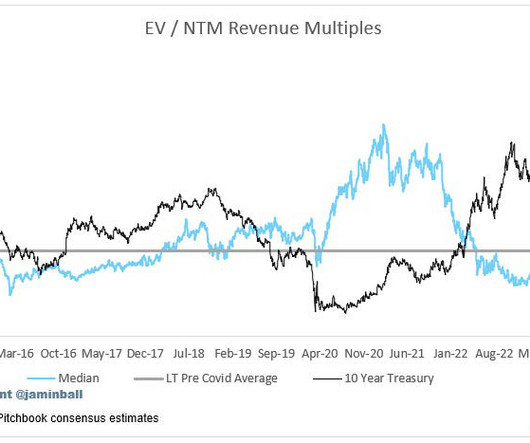

Subscribe now Shades of 2021 in Venture Markets Private markets are really starting to heat up, and I’m starting to see shades of 2021. This creates a lot of fomo in venture markets as no one wants their favorite prospect companies to get pre-empted, so they move first. Follow along to stay up to date!

Let's personalize your content