Microsoft as a Mirror - What We Can Expect for SaaS in 2023

Tom Tunguz

JANUARY 23, 2023

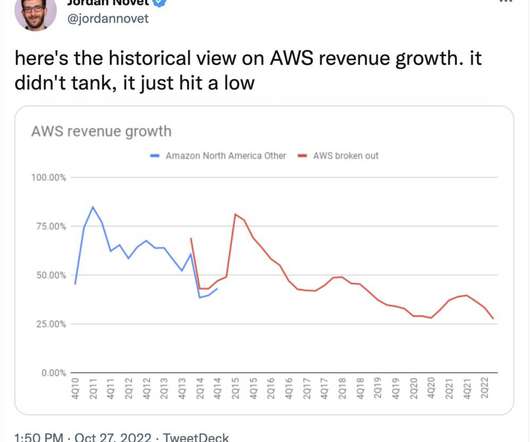

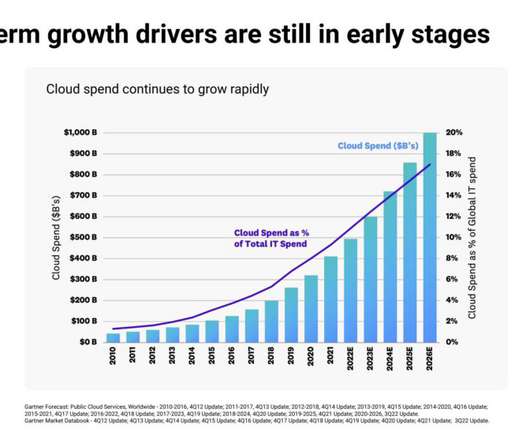

Yesterday, Microsoft announced earnings. We saw moderated consumption growth in Azure and lower-than-expected growth [elsewhere]. Expected growth across segments is muted with an average of 5% growth across these B2B categories. Azure ML revenue alone has increased more than 100 percent for five quarters in a row 4.

Let's personalize your content