The Vertical SaaS Gold Rush: Why Non-Tech B2B Is Growing 250%+ Faster

SaaStr

JULY 4, 2025

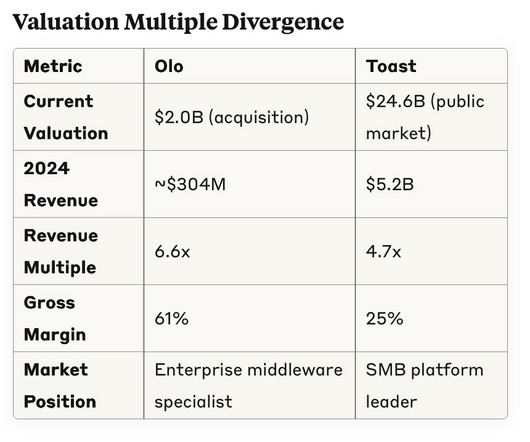

A restaurant isn’t dropping Toast’s POS system to save money. Regulatory Requirements Create Infinite Moats Try switching away from Toast when you’ve got 50 restaurant locations with integrated POS, payments, payroll, and compliance systems. These are companies buying their first real software platform.

Let's personalize your content