Generating growth: Insights from a former software company CRO | Episode 37

Payrix

MAY 14, 2024

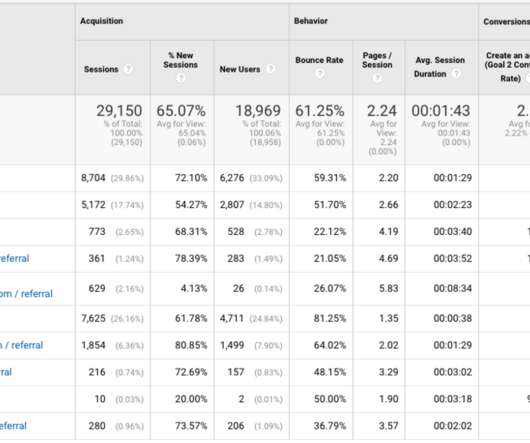

Before joining Worldpay for Platforms, he was CRO at Chargebee, a subscription revenue management platform that manages billing subscriptions and payments for companies throughout the world. During his tenure, Chargebee experienced high growth, scaling from processing about $3 billion in revenue to $13-14 billion.

Let's personalize your content