What is the SaaS Magic Number and How Do You Calculate It?

Stax

FEBRUARY 21, 2024

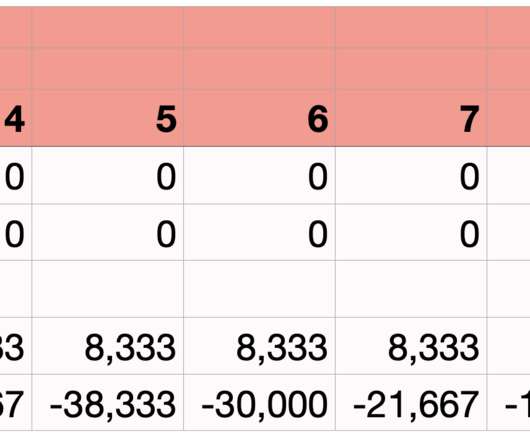

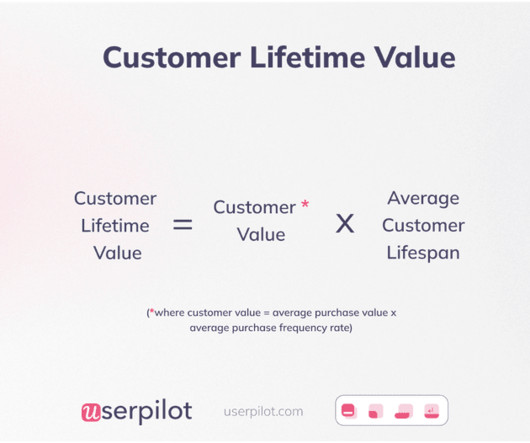

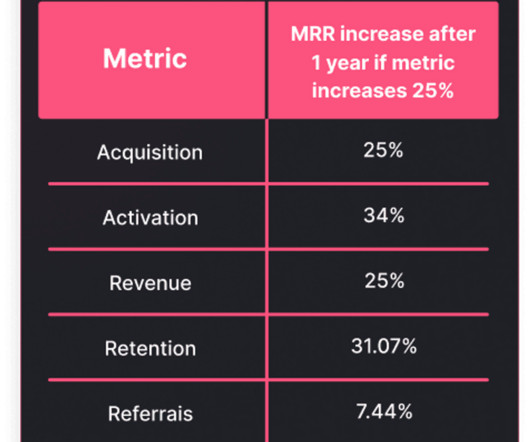

So, of course when it came to revenue-driving activities, Ford knew that success in marketing—and business—wasn’t about how much your marketing spend is, but how efficiently you spend it. Enter the SaaS Magic Number, which measures the return on sales and marketing spend in generating new subscription revenue.

Let's personalize your content