The State of SaaS – Global Data Trends from 1000+ Companies with Capchase Co-Founder/CEO Miguel Fernandez and 01 Advisors VP Kristen Clifford (Video)

SaaStr

MARCH 27, 2023

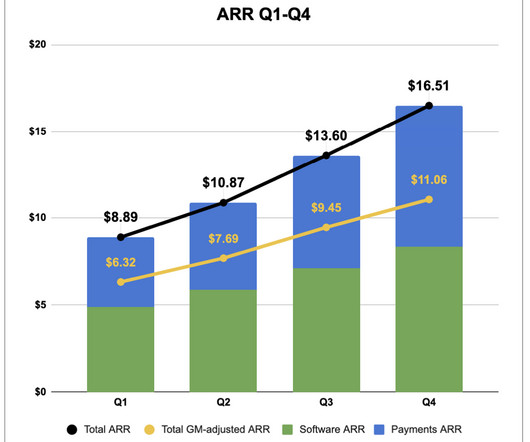

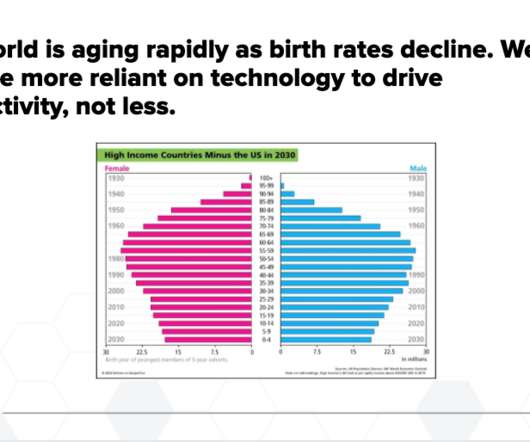

One, when you have really high gross margins, your cost base actually increases much slower than your revenue base. Think about additional integrations or additional workflows. Revenue growth is the Rule of 40 and you want that number to be above 40% generally. This is important for two reasons. Diversity yields results.

Let's personalize your content