The State of SaaS – Global Data Trends from 1000+ Companies with Capchase Co-Founder/CEO Miguel Fernandez and 01 Advisors VP Kristen Clifford (Video)

SaaStr

MARCH 27, 2023

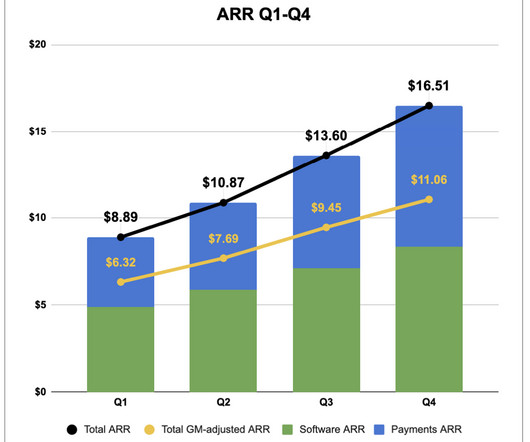

Most of the app sales and net retention comes from deploying software and tech-driven features that have 100% gross margin. Sometimes you can offer flexible payment terms to customers, but then finance part of the future payments to recover the CAC upfront and be able to redeploy the cash in the future.

Let's personalize your content