“Seed is Broken But There is More Seed Funding That Ever”: The Latest Deep Dive with Harry Stebbings and Jason Lemkin

SaaStr

MAY 27, 2024

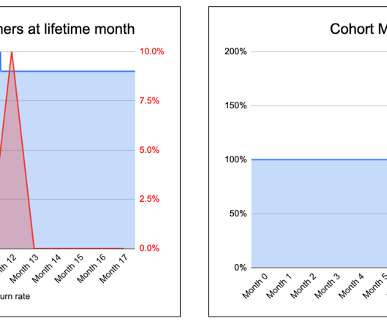

To IPO, companies need to triple their market share in their core market and have a churn rate of less than 3-4% per month. The market is flooded with capital, leading to higher valuations and unrealistic expectations. There is more capital available to startups than ever before. Venture capitalists are investing more money.

Let's personalize your content